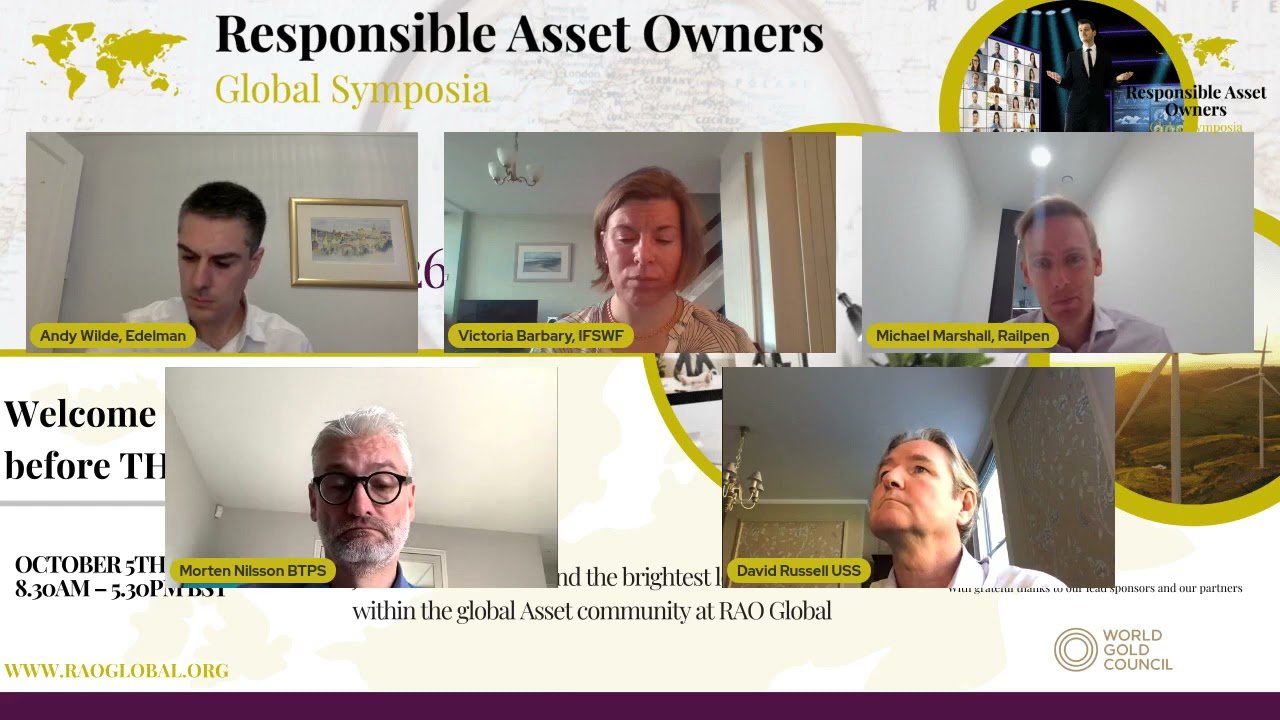

Panel session recordings

Join RAOglobal.tv for FREE

and enjoy all our valuable content and see you soon.

S&P Global Sustainable 1 is the central source for sustainable intelligence from S&P Global. Sustainable 1 matches customers with the ESG products, insights and solutions from across S&P Global's divisions to help meet their unique needs.

Our comprehensive coverage across global markets combined with in-depth ESG intelligence provides financial institutions, corporations and governments an unmatched level of clarity and confidence to successfully navigate the transition to a sustainable future.

Our data and well-informed point of view on critical topics like energy transition,climate resilience, positive impact and sustainable finance allow us to go deep on the details that define the big picture so customers can make decisions with conviction.

To learn more about Sustainable 1, visit

Introducing your single source of essential sustainability intelligence:

S&PGlobal Sustainable1

- Credit rating agencies, stock exchanges, index providers and auditors fill the gap for net zero in the financial sector with new alliance that will help put climate at the hear of every professional financial decision.

- There's no single action that will lead us to carbon neutrality. But there is a single source of essential sustainability intelligence providing unparalleled data and insight to accelerate your journey.

- Global sustainability policies are rapidly evolving.Keep up with the latest global regulatory developments affecting business trade, and capital investment.

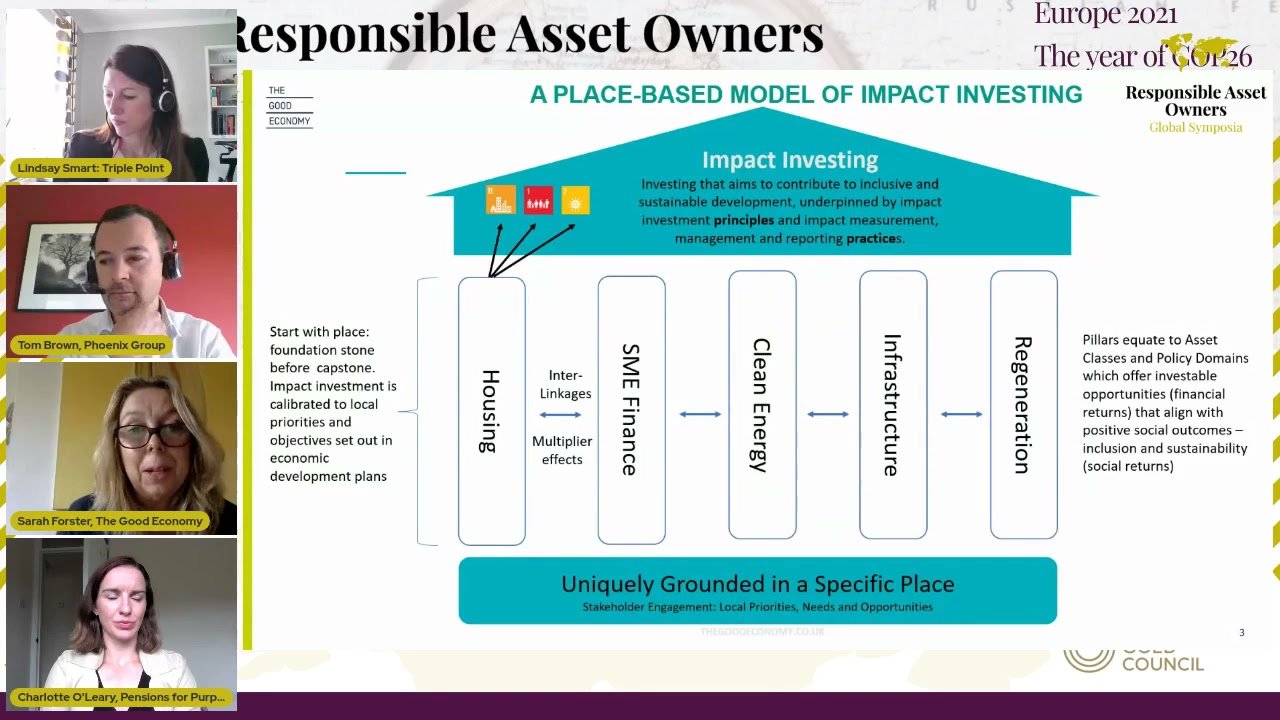

People | Purpose | Profit

Something happens when people come together

From the connections we make spring ideas. Fresh solutions to big problems, from how to improve global communications and heat our homes, to how to support businesses and drive the economy. And from solutions like these flow opportunities to create value.

We call it the Triple Point

It’s the place where people, purpose, and profit meet. Since 2004, we’ve been targeting this Triple Point in areas like digital infrastructure, energy efficiency and social housing, unlocking investment opportunities that make a difference.

Big problems create strong demand. Strong demand drives good investments. Good investments solve big problems. It means that investors never have to choose between financial returns and social impact. You achieve one by achieving the other.

For more information please contact

laura.williams@triplepoint.co.uk

Asset managers and consultants rely on MandateWire’s intelligence and data for timely information on institutional asset flows across Europe, North America, APAC, and India, The Middle East and Africa.

By leveraging close relationships with institutional investors globally, MandateWire provides asset managers with actionable intelligence on investor strategies and subsequent business opportunities. MandateWire's unique CRM Integration Solution takes the power of MandateWire –Intelligence, Market Data, Analysis, Investor/Consultant Directories and Documents, and centralized it within your CRM to dramatically improve the workflow of your sales team.

REQUEST A FREE TRIAL

Click here for our MandateWire Product Guide.

Convergence is a data and analytics company that has created an unparalleled platform comprising public and proprietary data, analytical products and insights that penetrates deep into the operations and infrastructure of the universe of Asset Managers.

For more information please contact:

ggainer@convergenceinc.com

CMA promotes well-functioning cross-border capital markets, which are essential to fund sustainable economic growth.

It is a not-for-profit membership association with offices in Zurich, London, Paris, Brussels and Hong Kong, serving more than 600 member firms in over 60 jurisdictions.

Among its members are private and official sector issuers, banks, broker-dealers,asset managers, pension funds, insurance companies, market infrastructure providers, central banks and law firms. It provides industry-driven standards and recommendations, prioritising four core fixed income market areas: primary,secondary, repo and collateral and sustainable finance.

ICMA works with regulatory and governmental authorities, helping to ensure that financial regulation supports stable and efficient capital markets.

For more information please contact

ravina.patel@icmagroup.org

Worldwide, 40 million children are subjected to abuse each year.

These children, too young and too scared to seek help, can too easily be hidden from view. Help For Children is dedicated to eradicating this silent epidemic.

Since 1998, HFC has worked to prevent and treat child abuse by providing grants to the most effective and efficient child abuse prevention and treatment interventions in 10 locations across 5 countries, making the world a safer place for children. Help For Children's UK Affiliate was formed in 2006 to expand upon the HFC global mission and help the most vulnerable and at-risk children in the UK.