Responsible Asset Owners Global Symposia

Insights & Releases

We occasionally post information pertaining to responsible investing, be sure to read our archive of posts below.

LP’s, GP’s & Market influencers seek innovators for collaboration

LP’s, GP’s, Influencers & Regulators gather together in NY

Date: Weds 28th June 2023

Location: Allen & Overy, 1221 6th Avenue, NY

Friday 5: CBI, Oatly, Plastics, Isles, Ravenous

Friday 5 from Giles Gibbons: Perhaps the progressive nature of the mission invites harsher criticism when consumers feel let down.

Researchers Develop Gold Nanoparticle Drug Delivery System to Target Tumors

Using Gold nanoparticles as part of biomedical engineering allows cancer treatments to be delivered much more precisely to the source of tumours and drastically reducing the side effects with much better clinical outcomes.

Coming soon: a Tinder-like matching app for Investors & opportunities in emerging markets

This analysis clearly shows that the concept of using a ‘Tinder-like’ approach to match potential investors with opportunities in emerging markets has great potential.

Scaling up to phase down

Compounding crises in energy security, affordability, and resilience make it more urgent than ever to identify and address the barriers to accelerating transition of the power sector.

Super.com Raises $85M Series C to Grow Savings Super App for Everyday Americans

Super.com continues to expand the ways in which it can help their customers save money. The company will be scaling product and engineering resources to meet demand for multiple features that customers are asking for within the super app.

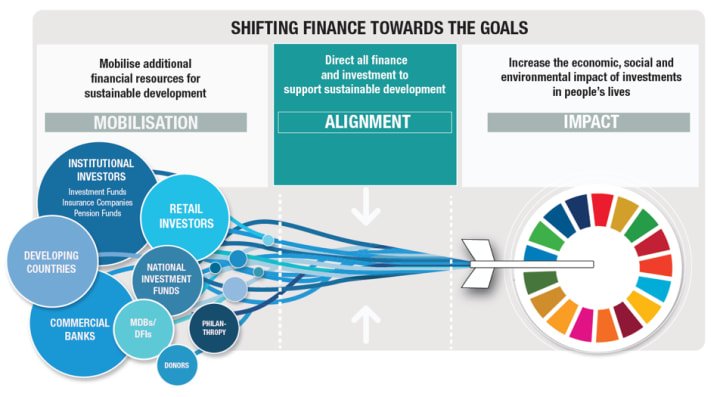

Aligning public and private investments

The World Bank says solutions to ensure that public and private markets complement each other will see companies and investors getting the best of both worlds.

The route to decarbonisation from thought leaders

Katherine Preston from OMERS, Kevin Mahn Media Influencer and President of Hennion & Walsh join Lane Jost of US Edelman to tease out the financing needs for decarbonisation and infrastructure improvements.

Friday 5: Dove, Advocacy, Salons, Banks, Repairs

If your bank ignores your plea, consider switching to a bank that doesn’t invest in fossil fuels. Bank.Green offers a directory of the best banks in your area; helping pave your way to becoming a climate-conscious consumer.

The role of the blue economy in a sustainable future

What’s the true colour of money? Blue finance and investment. There is a major opportunity to bring innovation to blue finance and it must be seized.

Biden administration releases road map to scale up nuclear, hydrogen, and energy storage

The Biden administration aims to halve emissions by 2030 and hit net-zero emissions by 2050. These fast-approaching deadlines mean that the next few years are critical for redrawing the energy landscape.

Pension industry in need of 'big reform' to deliver higher returns, Chancellor says

Jeremy Hunt “My concern is that Pensioners and future Pensioners are not getting the returns they could expect” And risk Mr Hunt, what about risk?

Latin America Q2 2023 Guide to the Markets (JP Morgan AM)

The composition of economic growth across Latin America from JPMorgan

Japan: 25 years of adding liquidity and counting

Former speaker at RAO Global Europe 2022 and Chief Economist for OMFIF Neil Williams, shares his thoughts on what he thinks the Bank of Japan will do next, and when, in it’s approach to deflation under the guidance of the new Governor at the Bank of Japan, Kazuo Ueda

Special Edition: Sustainability Reporting and Materiality

The lay of the land: in a fast-changing sustainability reporting landscape, what do you need to know? Giles Gibbons and the Good Business team tease out emerging regulations from newly-developed global task forces we sustainability reporting evolve at a pace hitherto unseen.

The Role Of Voluntary Business Initiatives In An Era Of Political Fragmentation

Business-to-business collaboration to tackle climate change and other global public good priorities may not be enough to change the tide. But it may gradually create an awareness that humanity has a new common enemy - the real enemy is not “them” but “us” and collaboration across political and cultural divides is the only way to safeguard the future.

Zurich teams up with South Pole to support businesses with climate adaptation and mitigation

There were 10 in the bed and the little one said, “Roll over, roll over” so they all rolled over and one fell out….. More to follow?

Growing Pains: Responsible Investing Reaches Adolescence

Asset owners and managers must work with regulators and policymakers to help address ambiguity and confusion in defining ESG integration and other responsible investing practices. Collaboration is key.

Digital Assets: Regulation and Infrastructure for an Evolving Economy (OMFIF)

The OMFIF concludes: One of the most exciting areas where the digital asset ecosystem can incite change is the infrastructure of financial markets. Over the course of researching this report, we have observed a convergence between the architecture of the crypto investing and decentralised finance worlds and that of traditional finance.

IFSWF Direct | How SWFs Manage Long-Term Risk

Robert Marsalle of General Investments Partners tells IFSWF he believes believes that there will be “renewed interest in infrastructure investments, driven by their ability to provide stable cash flows, less correlated returns and a hedge against inflation.”