In uncertain times, its important to look at historical facts

Written By Adrienne Lawler

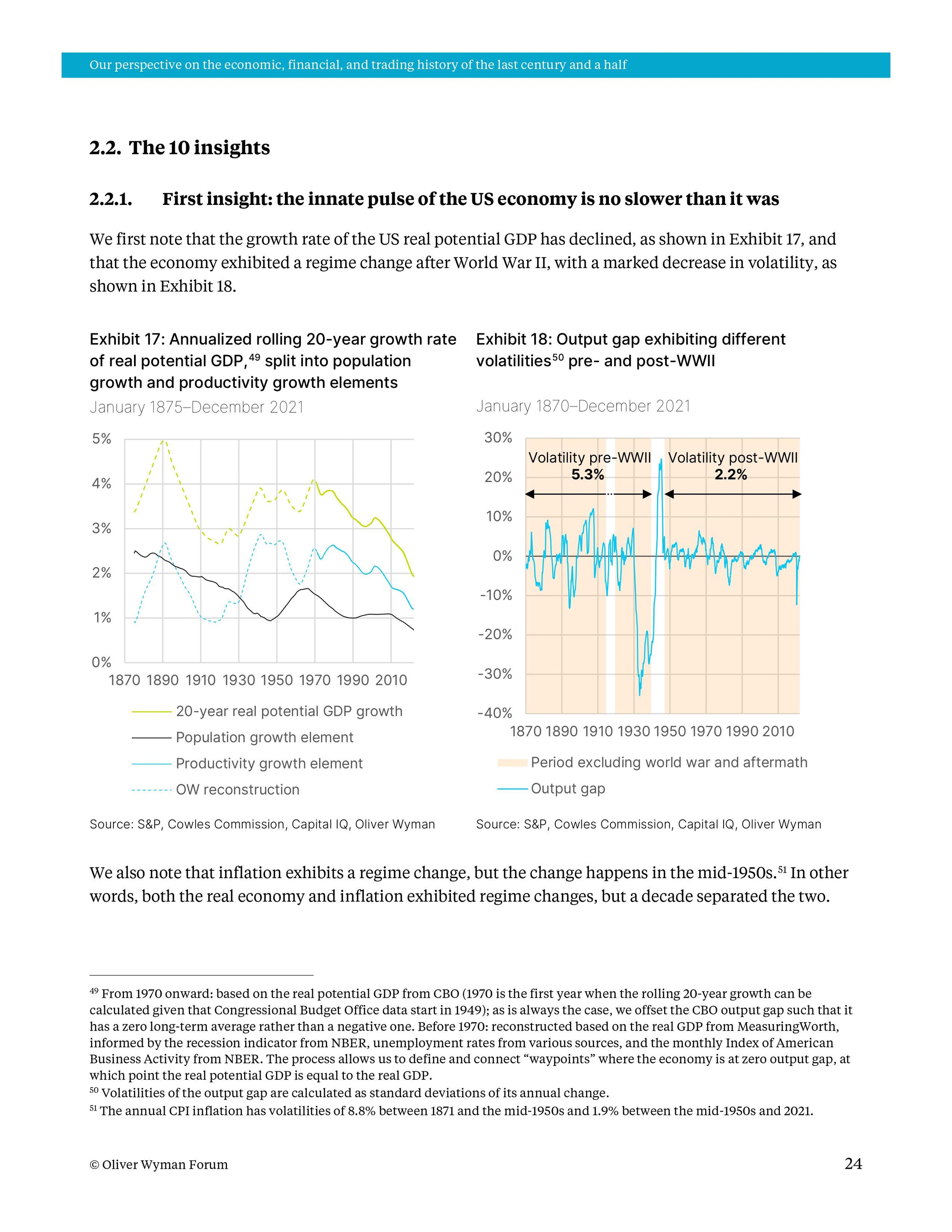

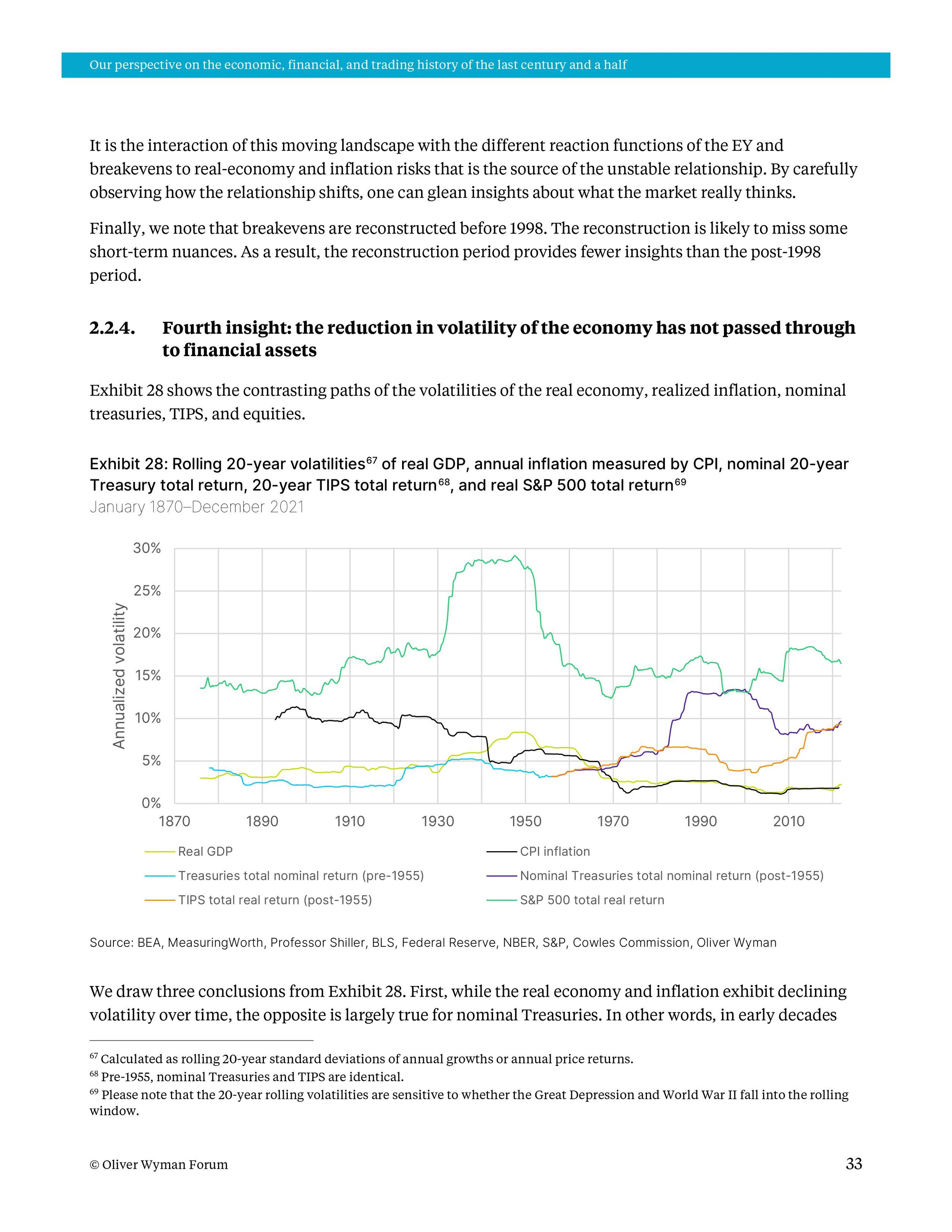

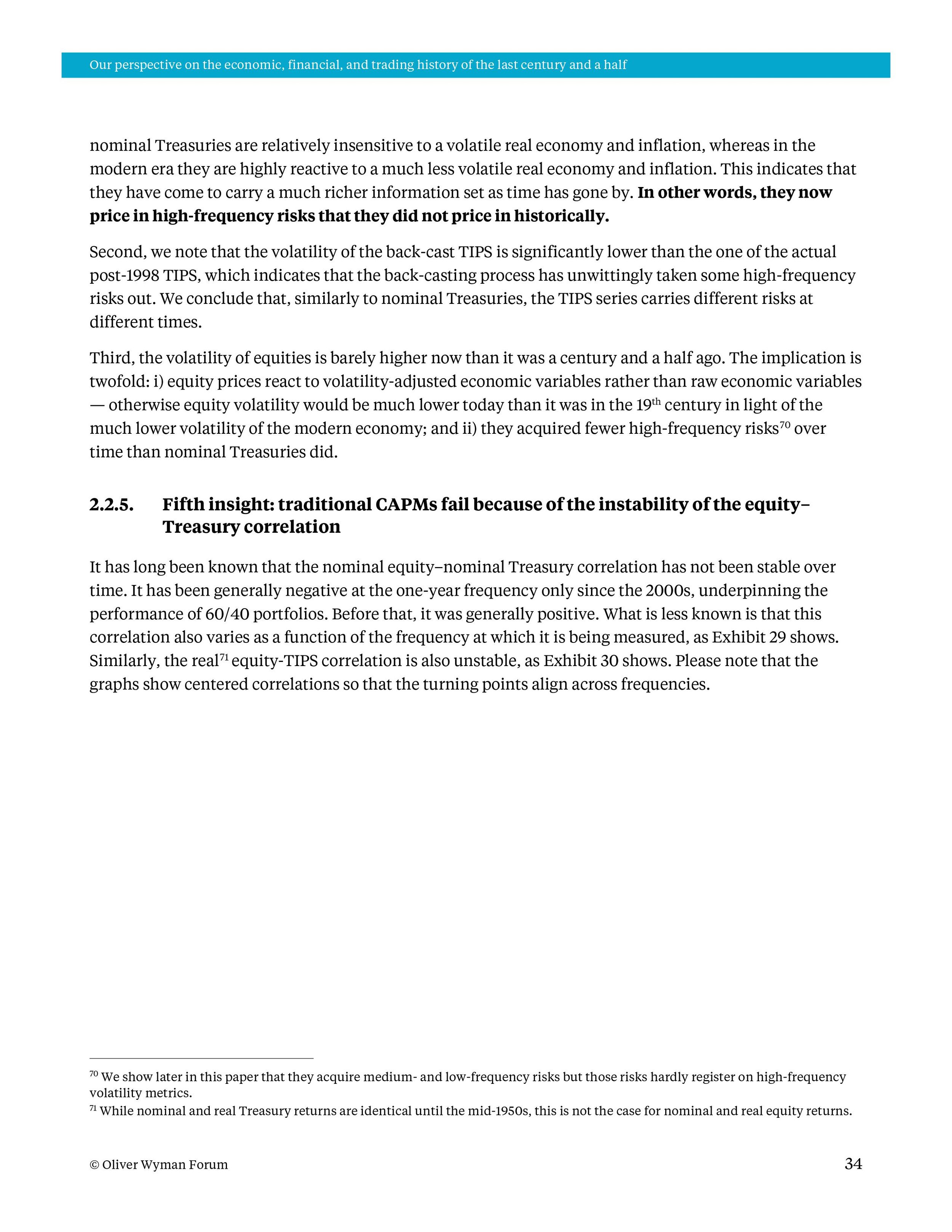

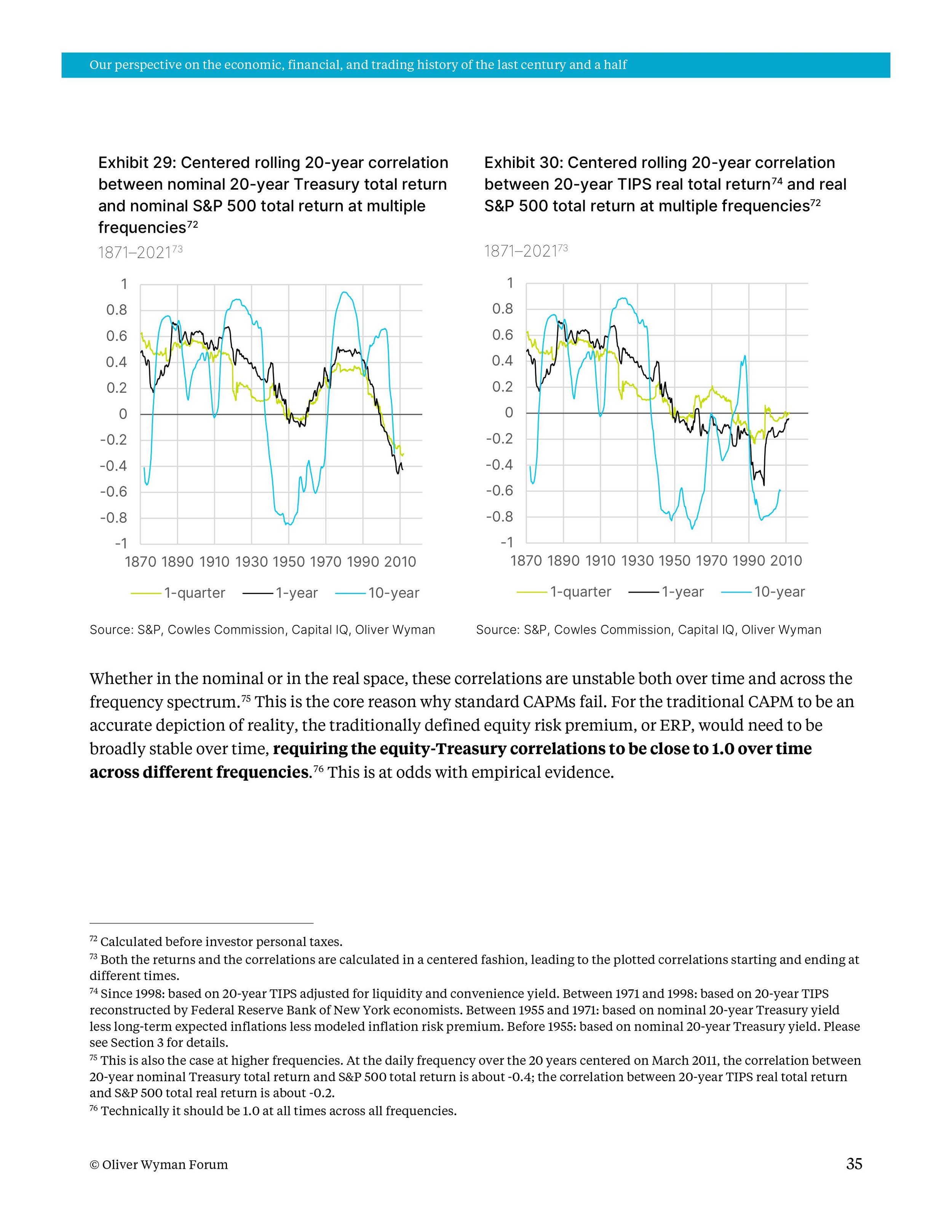

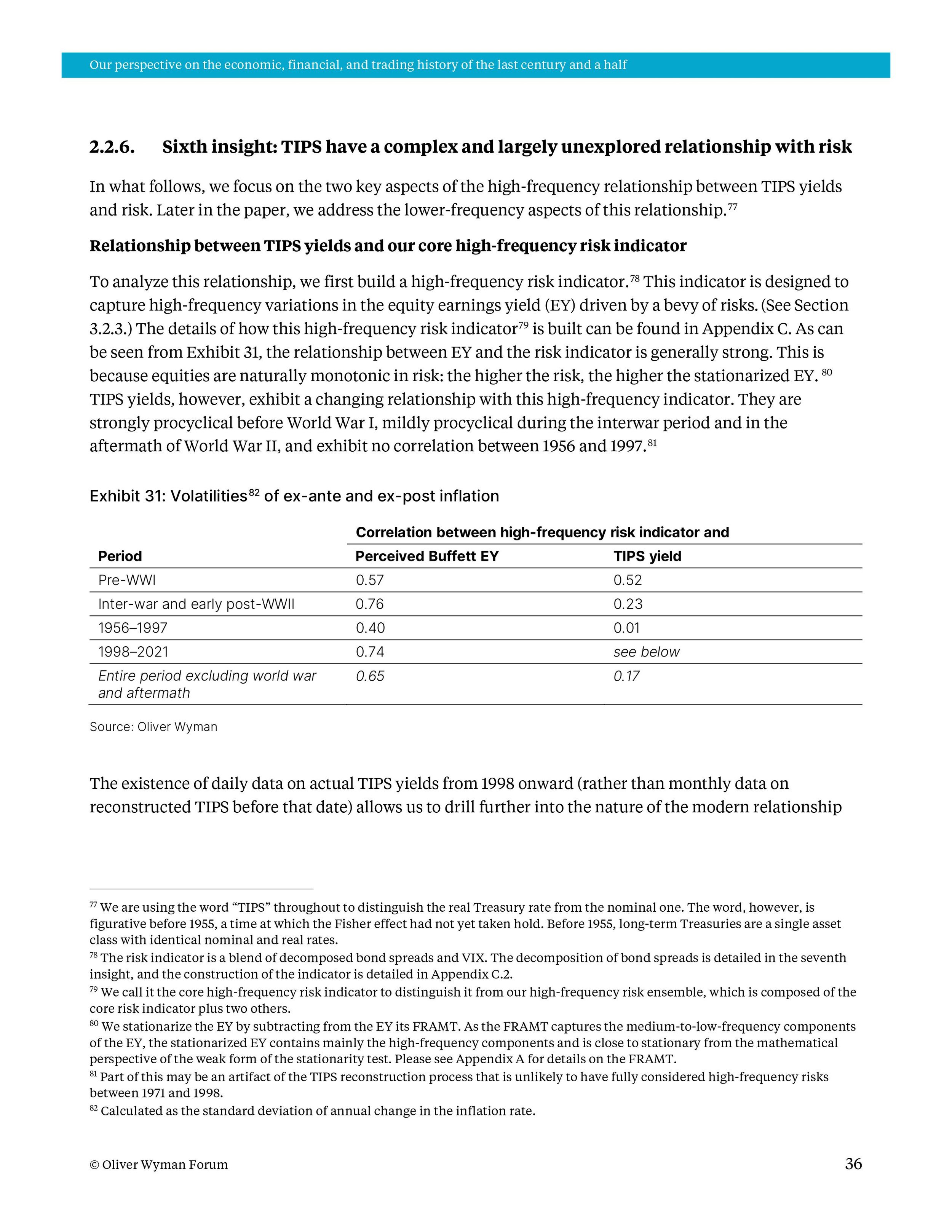

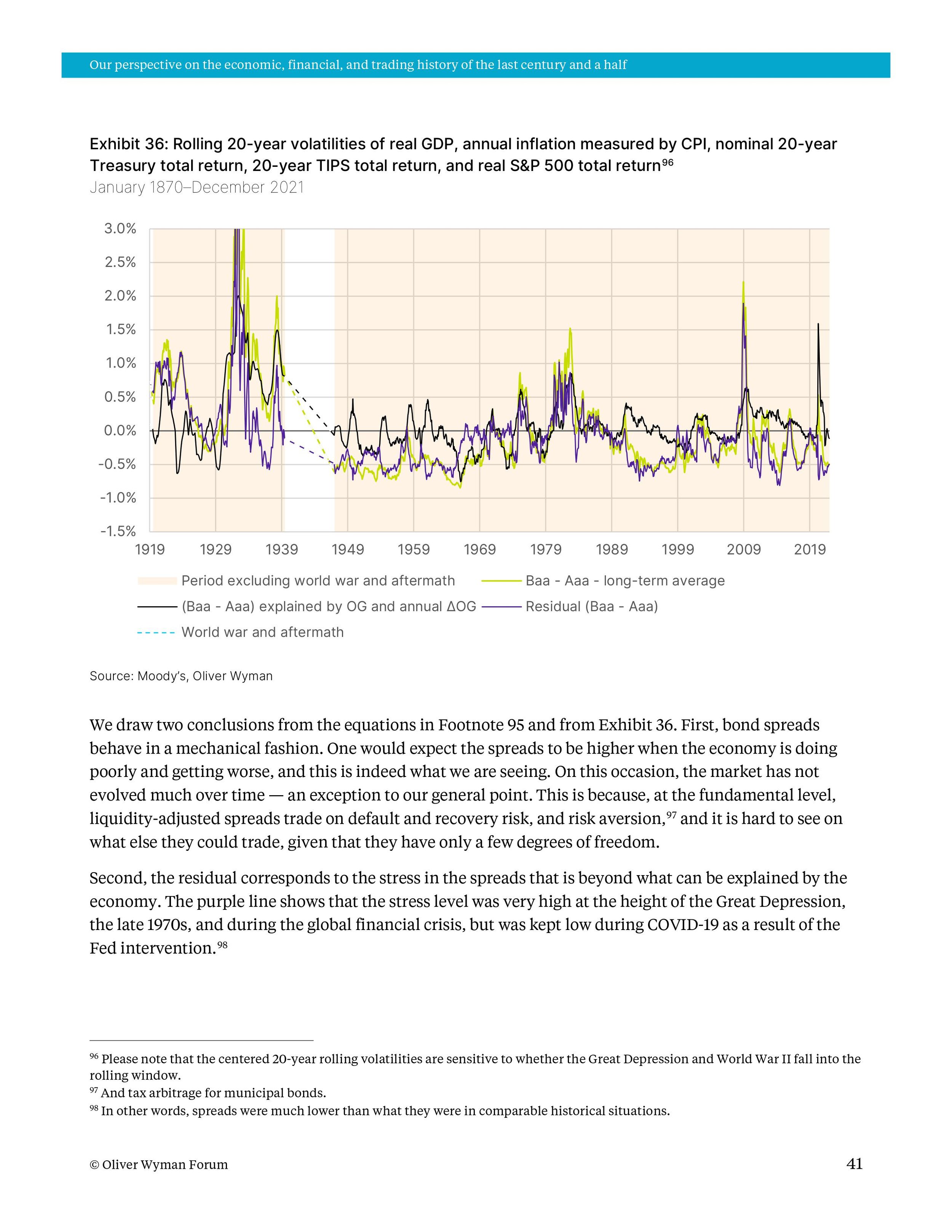

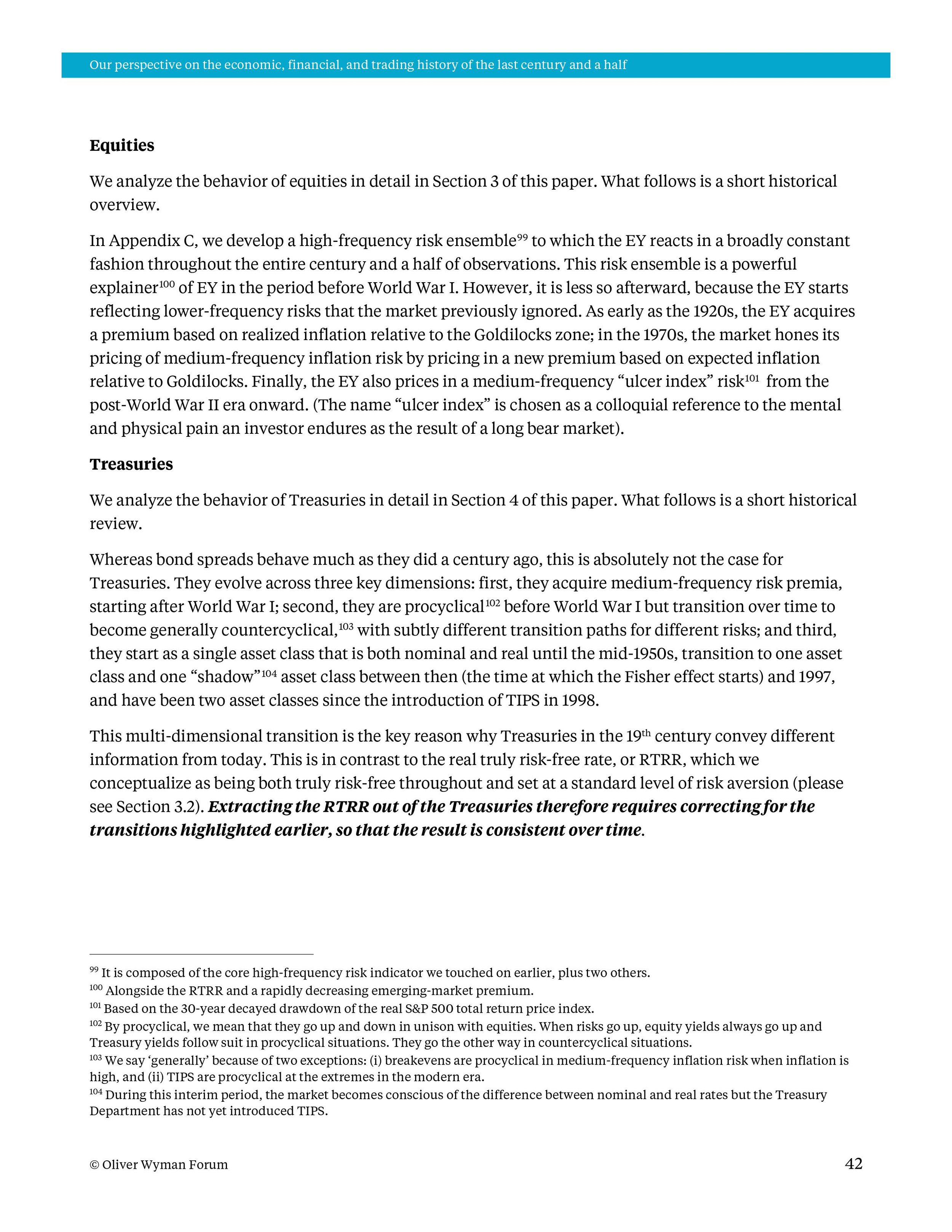

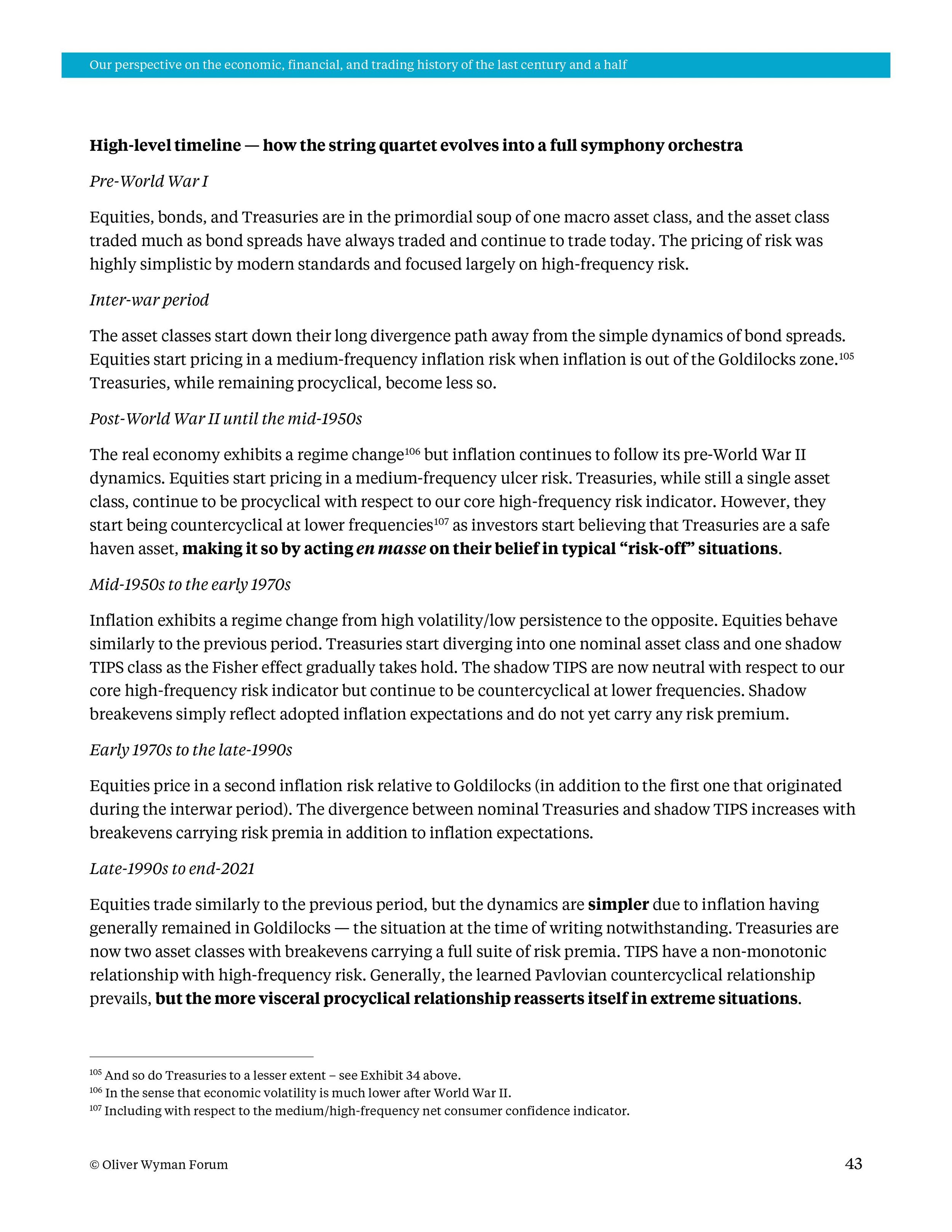

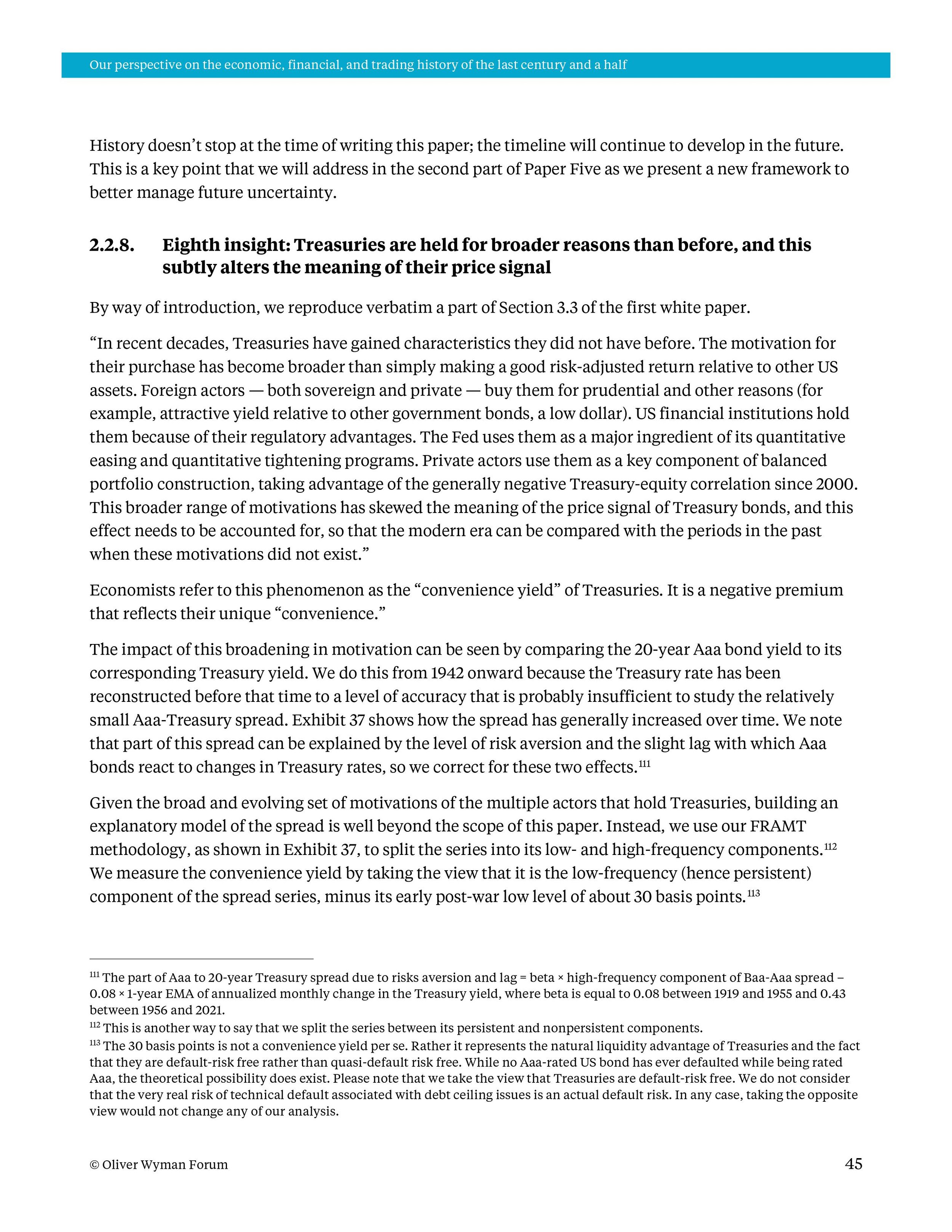

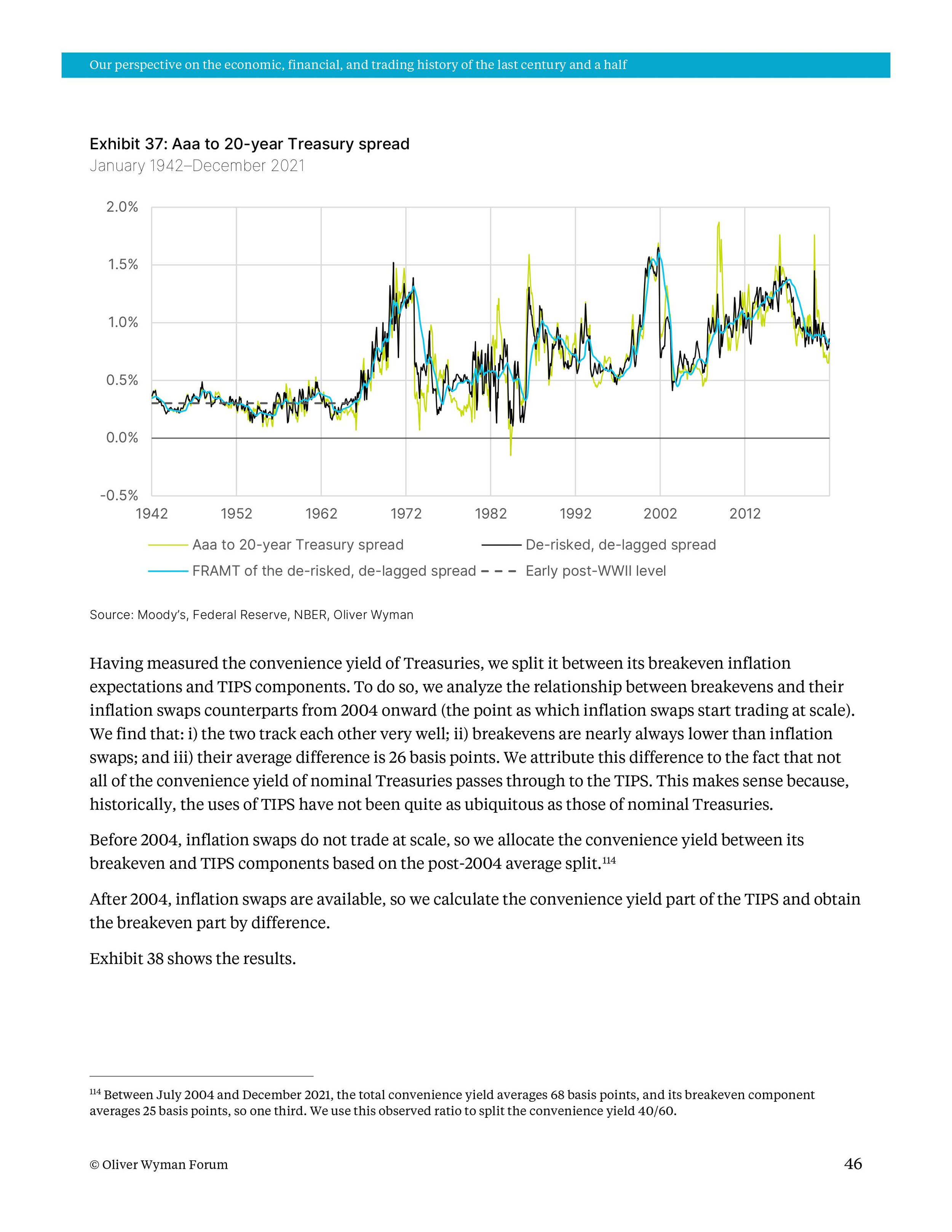

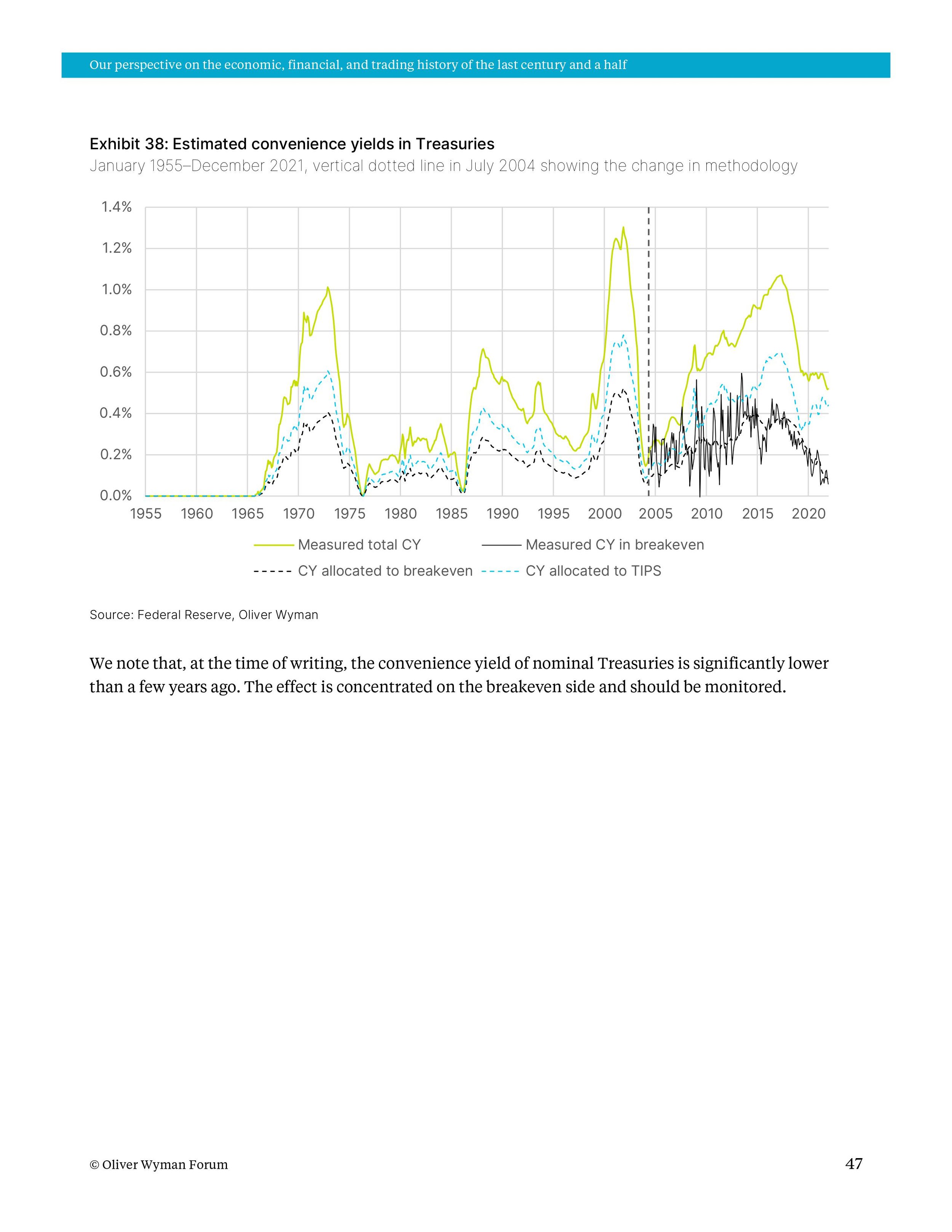

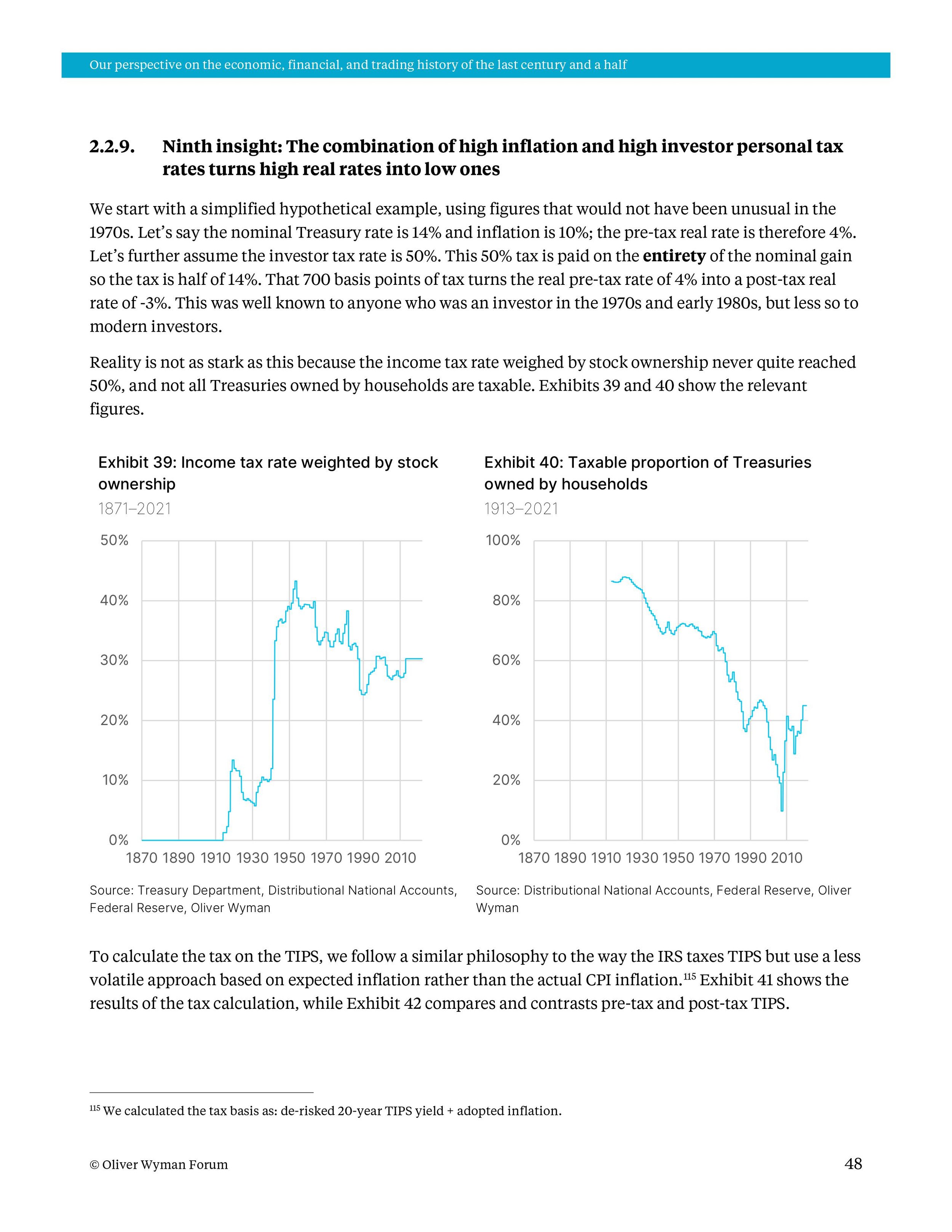

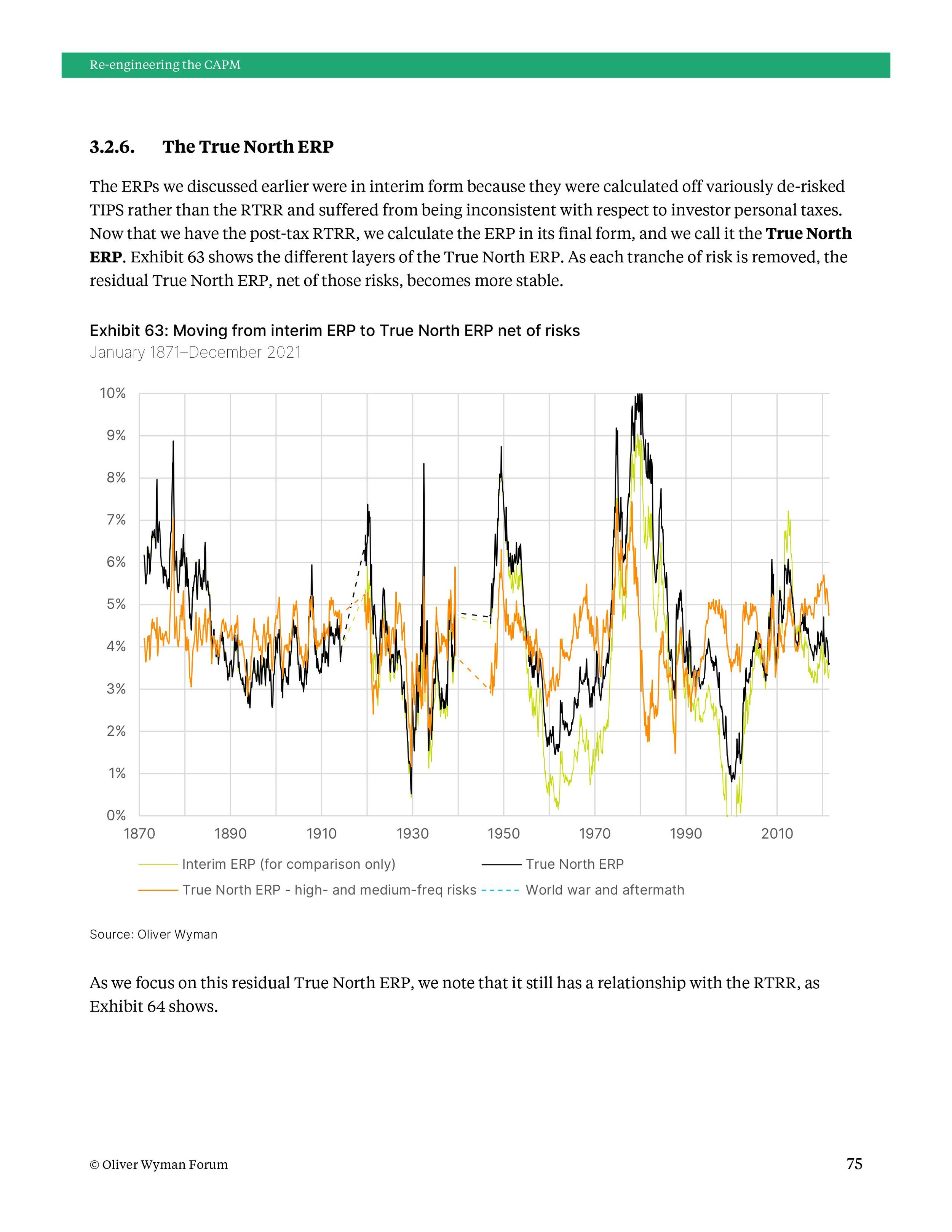

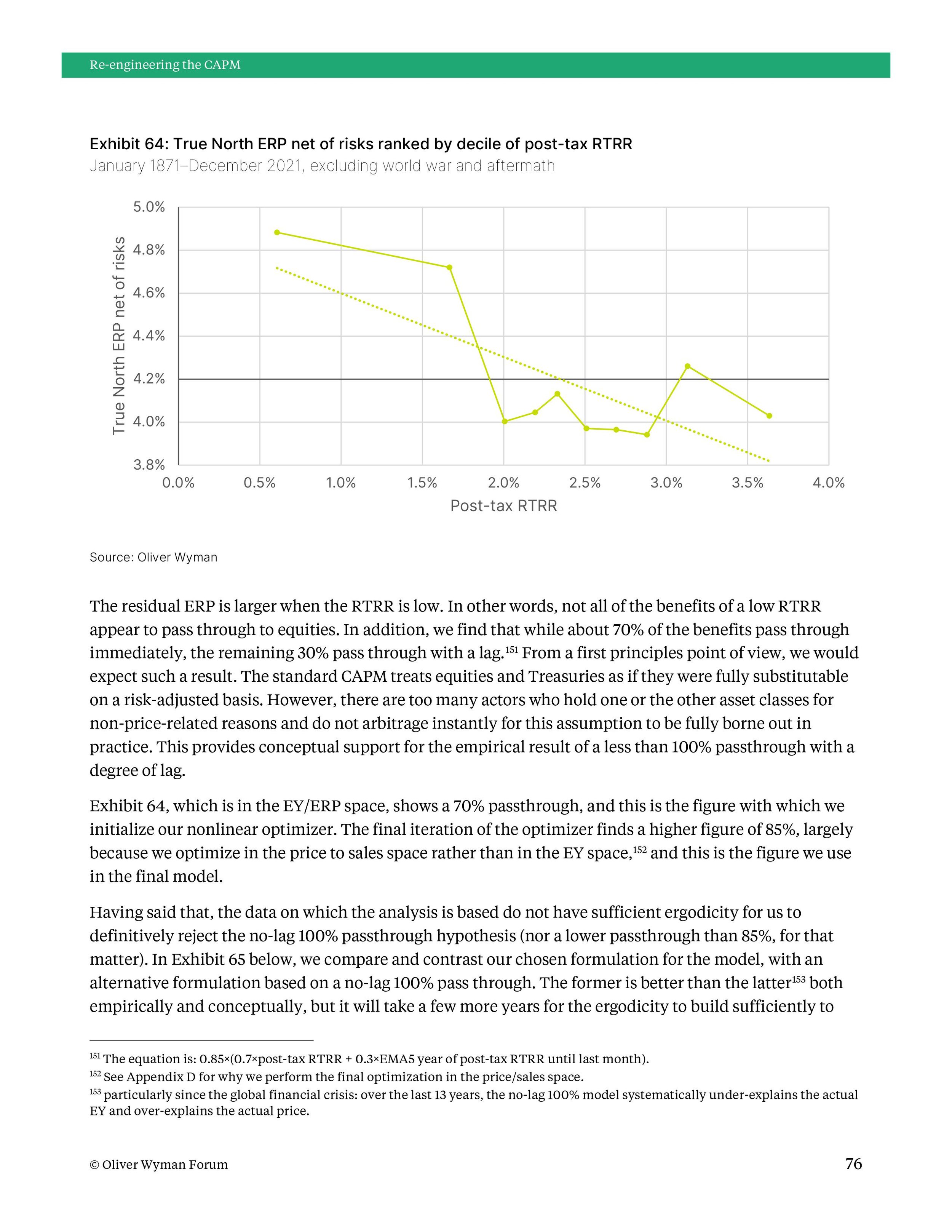

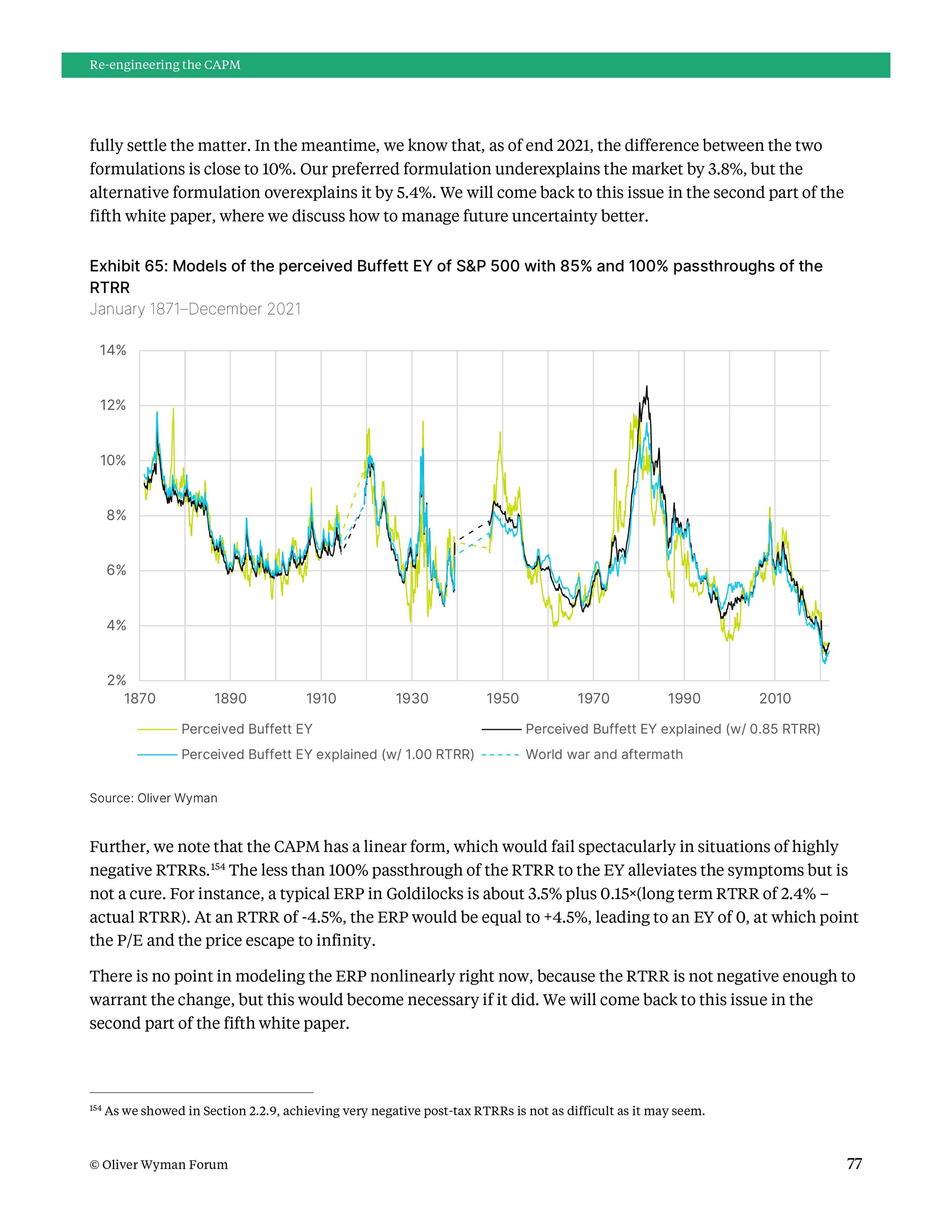

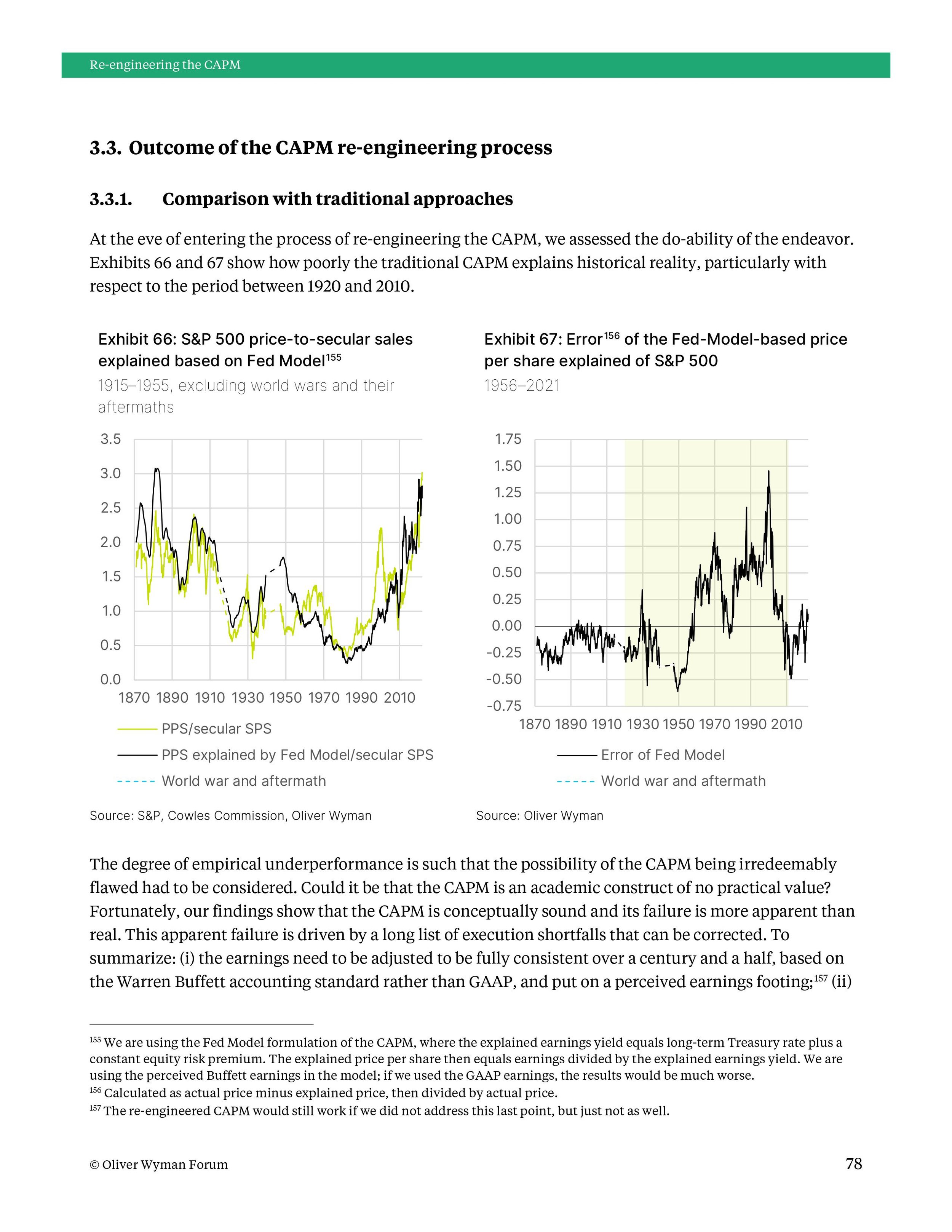

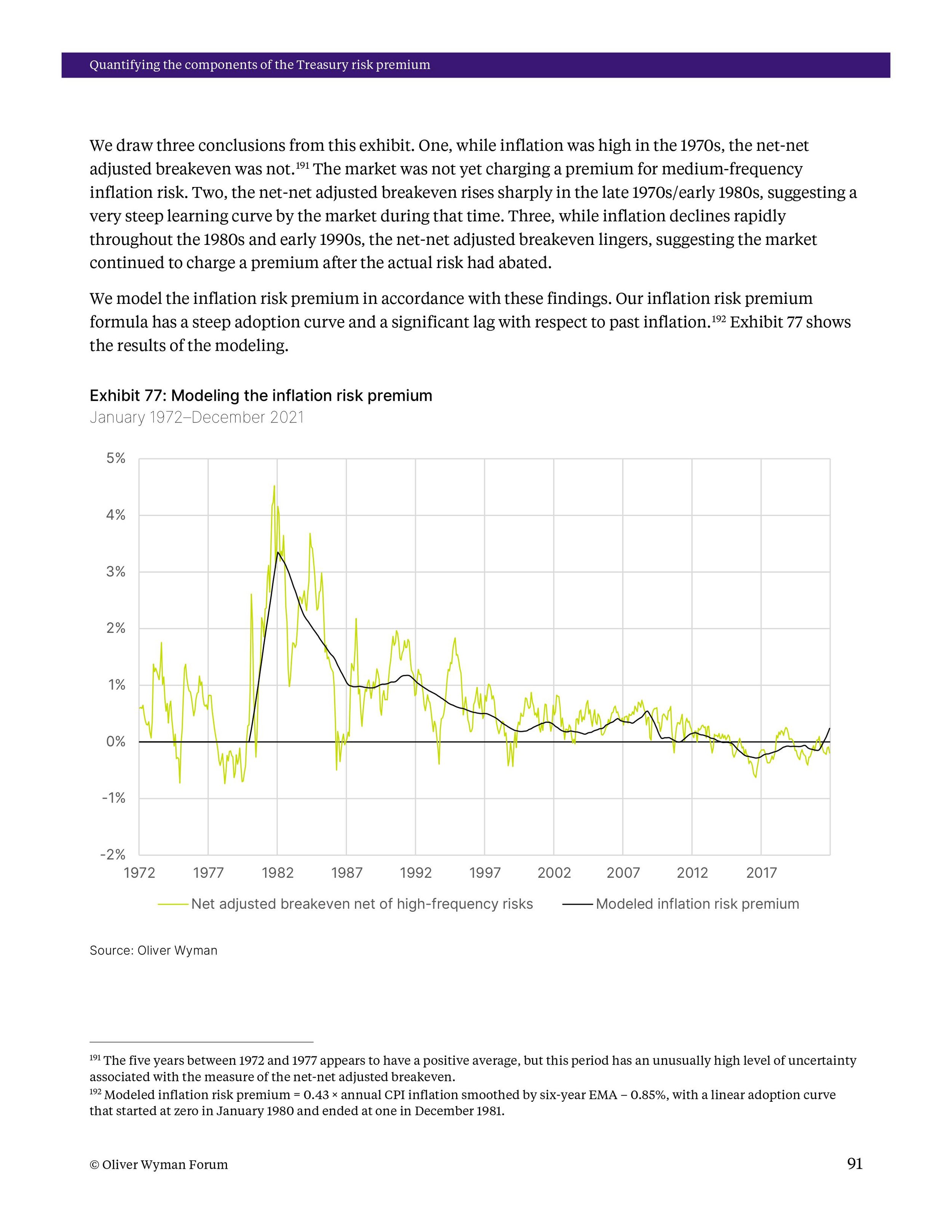

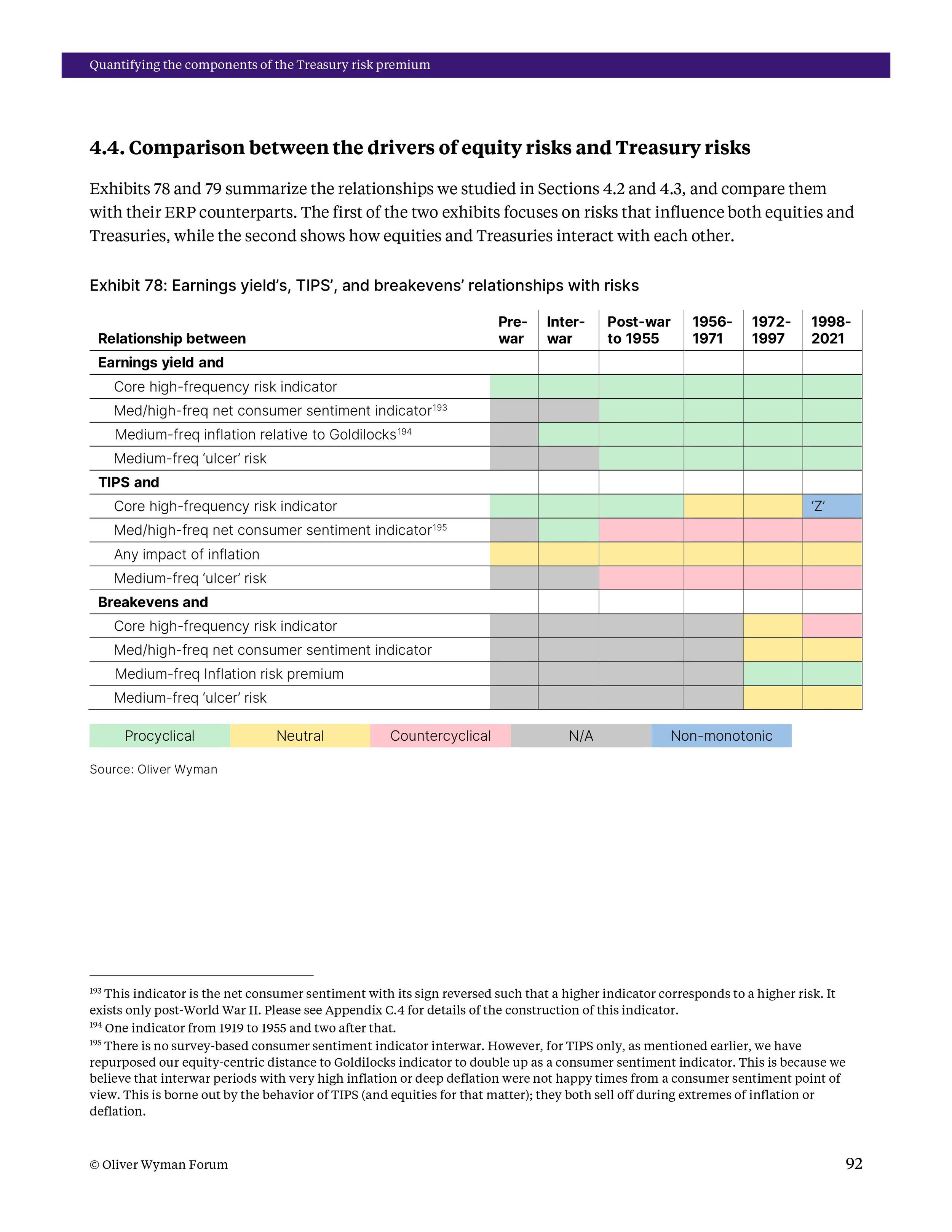

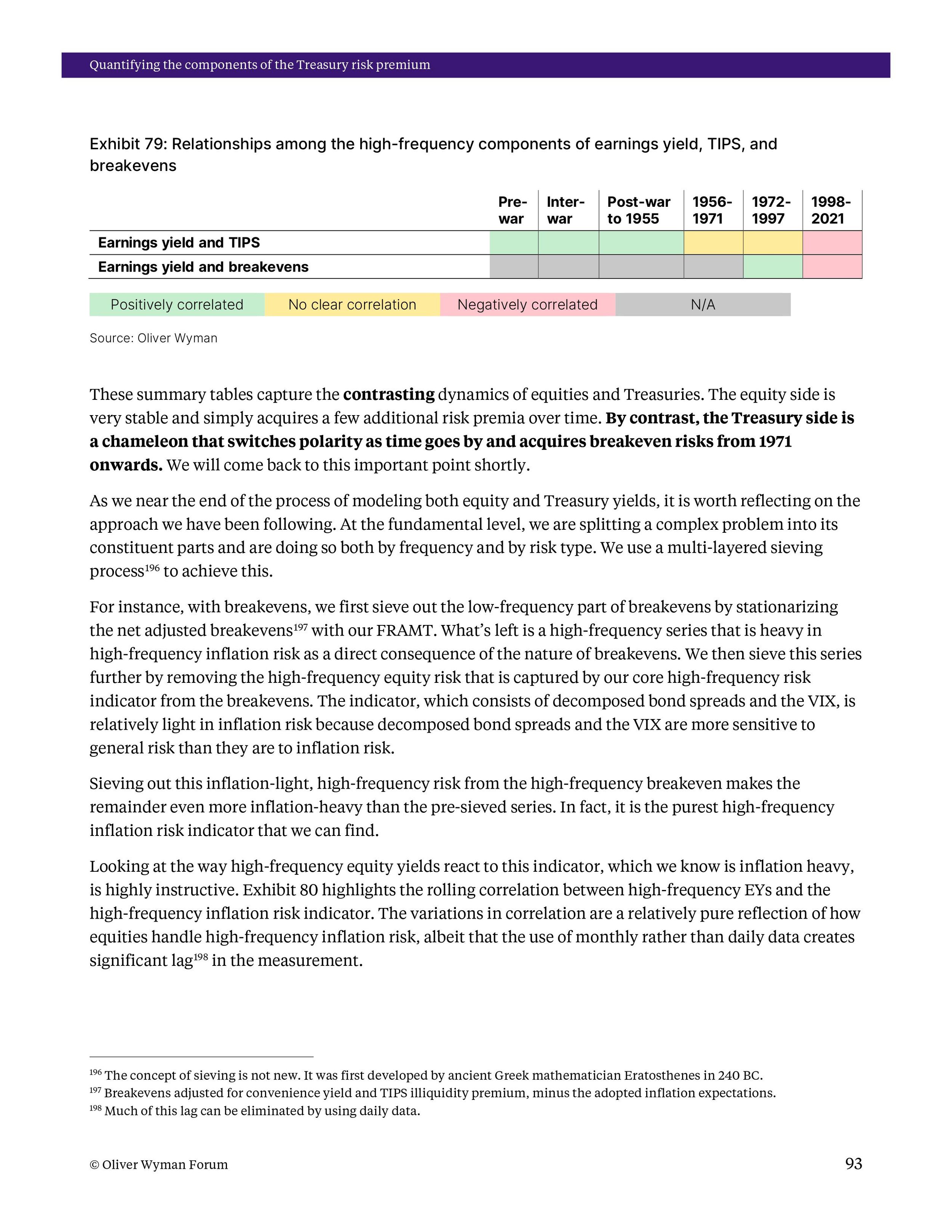

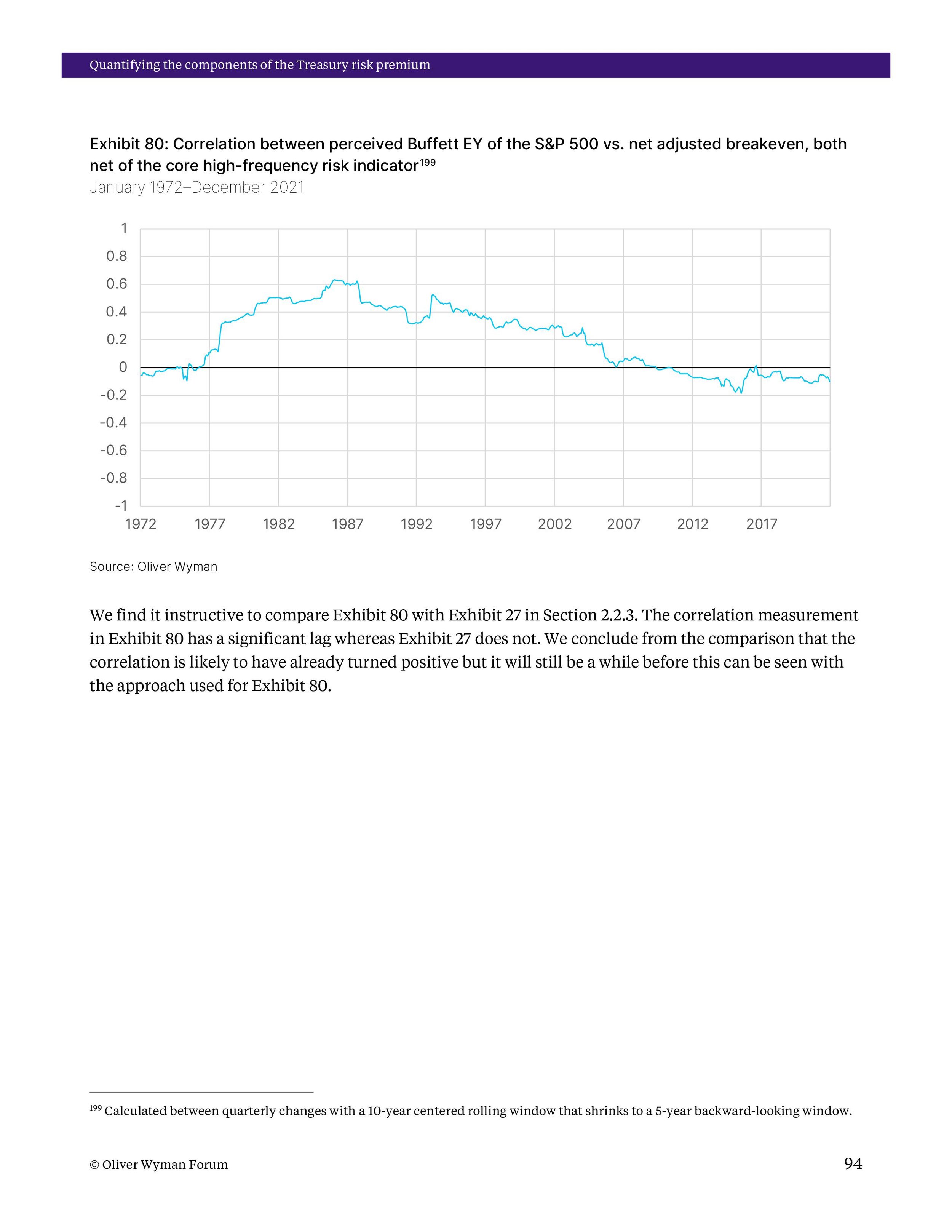

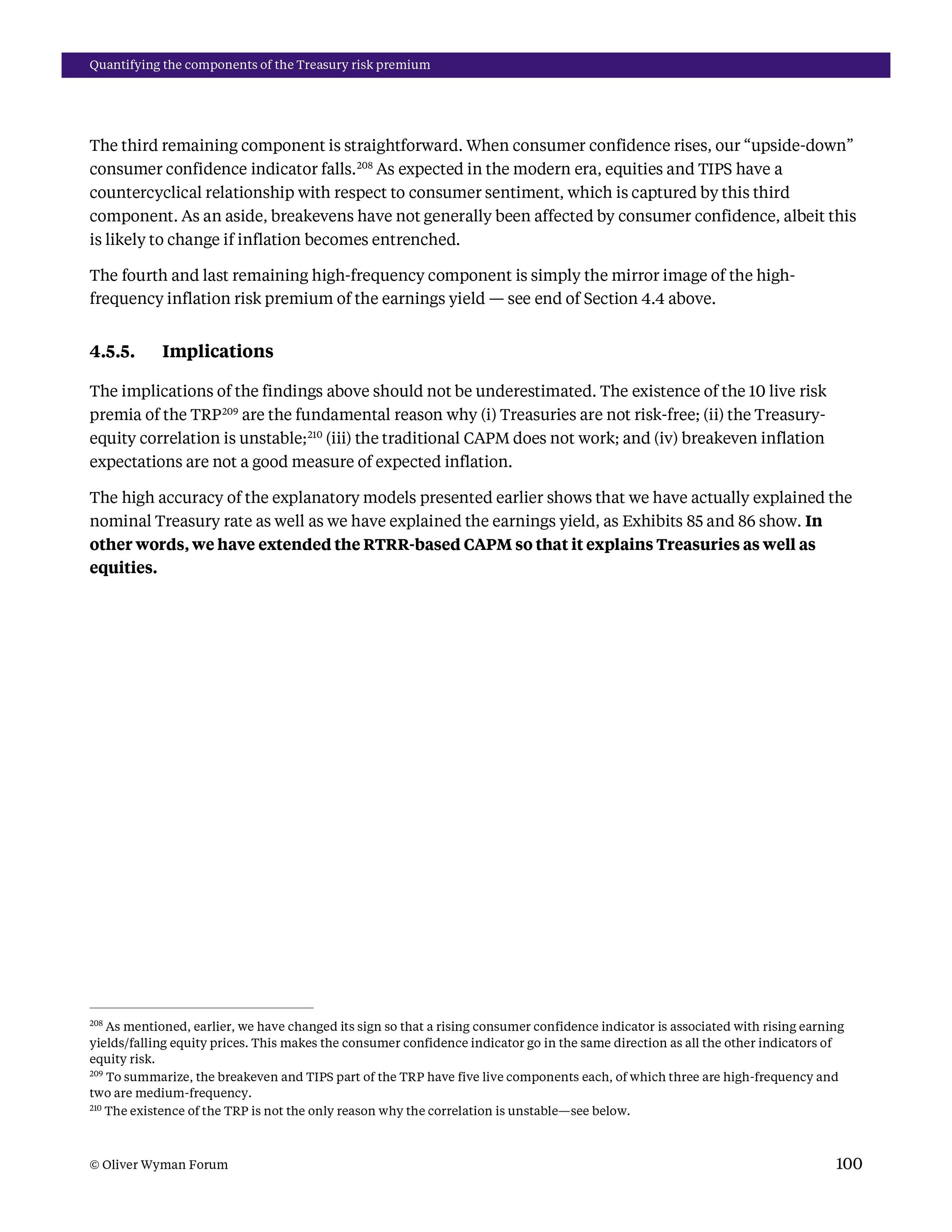

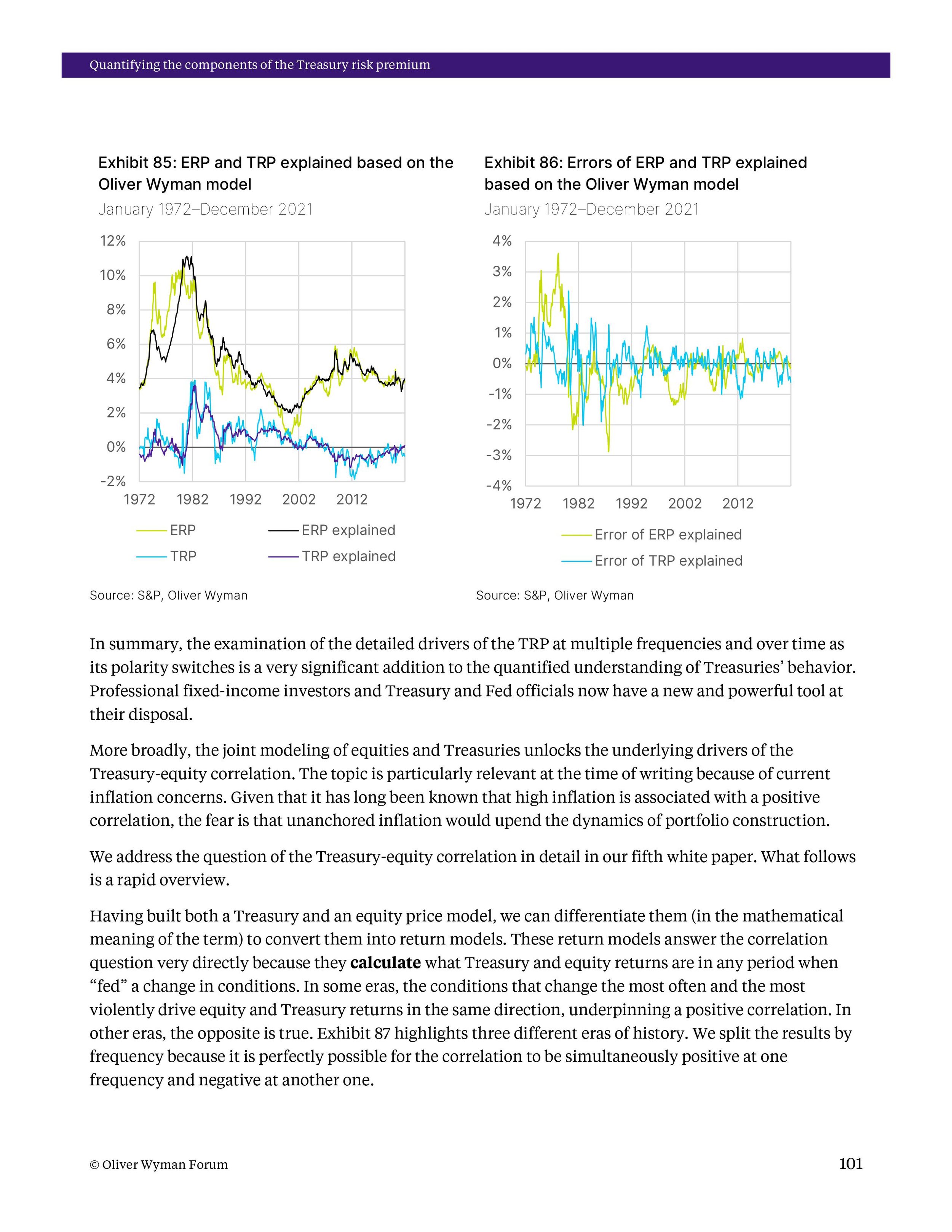

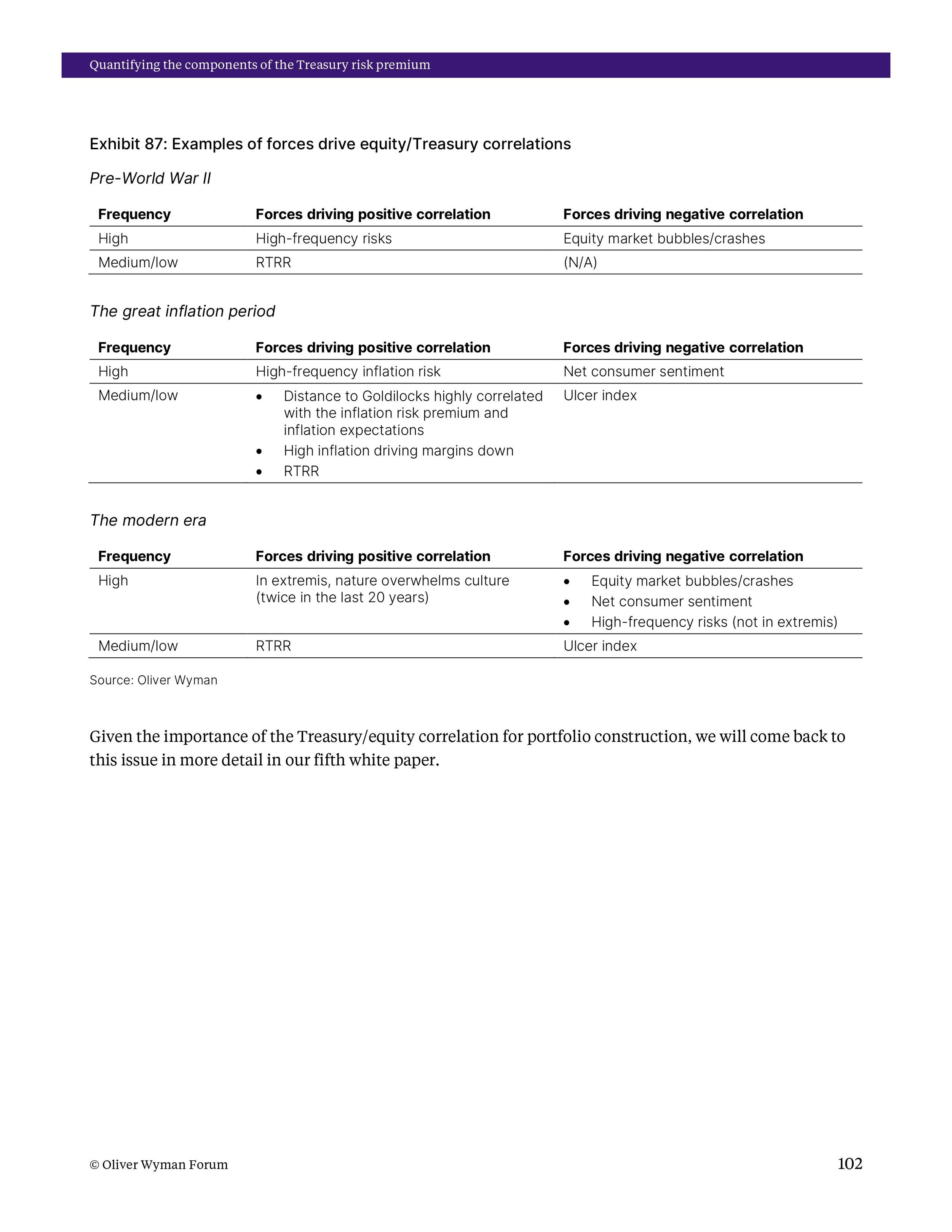

This white paper is the third in a series. First, it introduces a new equity market valuation metric that outperforms the traditional ones. Second, it reveals 10 largely unknown but highly significant facts about the U.S. economy and financial markets, which improve investors’ ability to navigate market moves. Third, it re-engineers the Capital Asset Pricing Model (CAPM) to make it work in practice. And finally, it uncovers the 10 hidden risks in Treasuries and extends the CAPM to the Treasury market. The work combines finance, accounting, analytics, economics, history, and sociology to bring about the first comprehensive overhaul of the science of valuations since the 1970s.