Investment Banker Salary and Bonus Report: 2022 Update

If you're new here, please click here to get my FREE 57-page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking. Thanks for visiting!

I did not expect to revisit investment banker salary and bonus data for a while, but the banks ruined my plans by changing base salaries multiple times in less than a year.

Unfortunately, that has made it difficult to determine the “average ranges.”

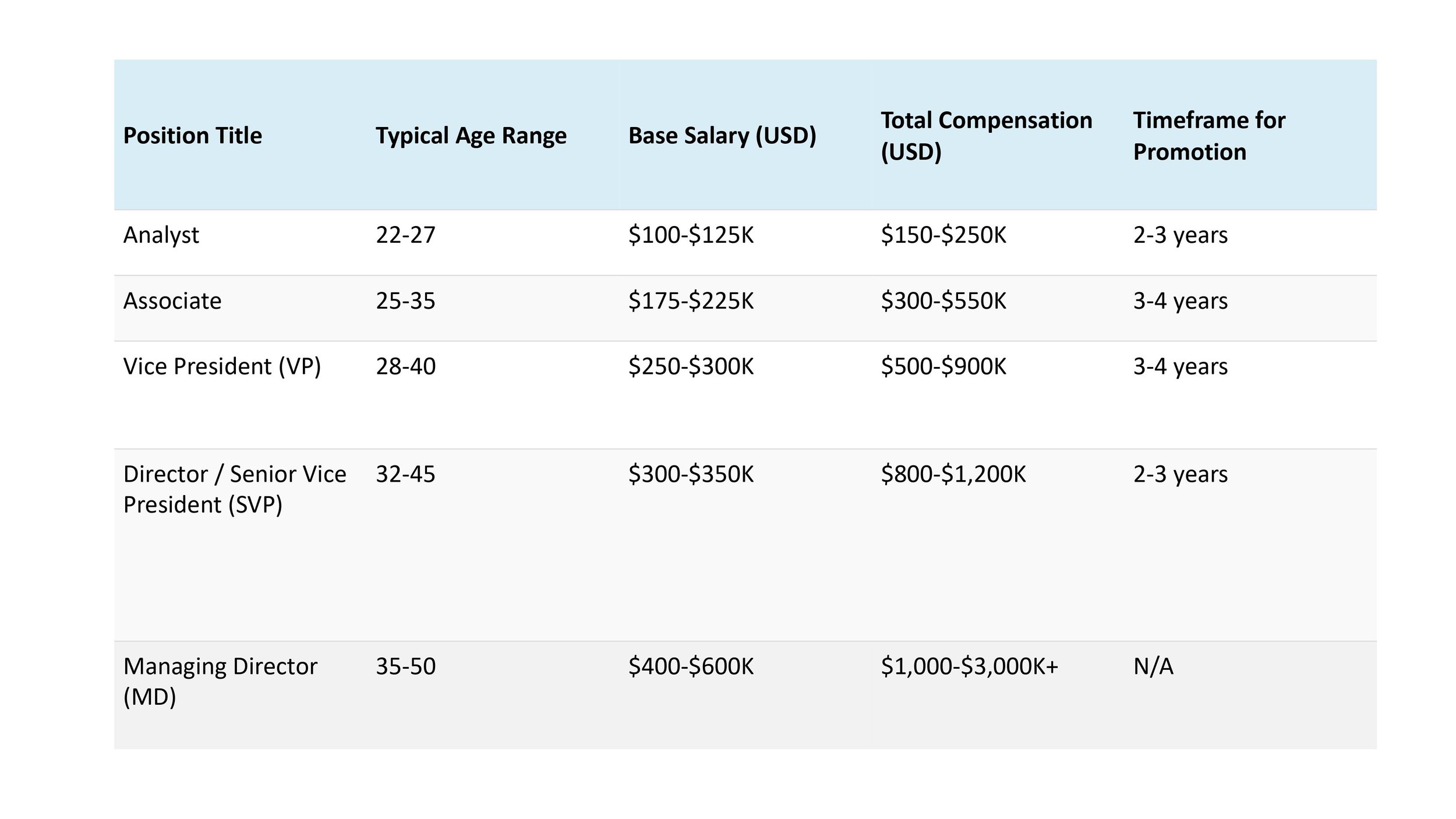

As a result, I am listing below the new base salary ranges for U.S.-based roles at large banks as of early 2022, along with total compensation from 2021.

This is slightly confusing/inconsistent, but I don’t believe that total compensation will change much with these new, higher base salaries (see below), so I’m sticking with this method:

NOTE: All numbers are pre-tax and include base salaries and year-end bonuses, but not signing/relocation bonuses, stub bonuses, benefits, etc.

Yes, these are substantial pay increases for most levels.

But the ranges are also much wider now.

Before you leave an angry comment to say that you or your friend earned above or below these numbers, I want to offer a quick explanation:

Investment Banker Salary Changes vs. 2021 and 2020

I am giving very wide ranges for the compensation here because:

Midway through 2021, banks increased base salaries for Analysts from $85K – $95K to $100K – $110K. And then, in January 2022, many banks increased Analyst base salaries again so that 1st Years earn $110K and 2nd Years earn $125K.

Meanwhile, banks increased the base salary progression for Associates from $150K – $200K to $175K – $225K.

And then various banks also increased base salaries for VPs, Directors, and even MDs.

Finally, different banks paid very different bonuses over the past 12 months, even to “top performers” at the same level. More on this below.

Here’s an example of the specific problem that all these factors create.

Let’s say that a Year 1 Analyst in 2021 reported a bonus of $80K.

This Year 1 Analyst was on an $85k base salary in the first half of 2021, but banks raised this to $100K in the second half of this year.

At the same time, this person became a Year 2 Analyst, which meant a new base salary of $105K.

But in January 2022, banks increased base salaries to $110K for Year 1 Analysts and $125K for Year 2 Analysts, so this person might now be on a $125K base salary.

So, what is his total compensation for “the past year”?

Is it $80K + $85K = $165K?

How about $80K + $85K * 0.5 + $100K * 0.5 = $172.5K?

Or is it $80K + $100K = $180K?

Or should we go with $80K + $110K = $190K?

I lean toward the first two numbers because, in all likelihood, banks will reduce bonuses due to these higher base salaries.

Here are the average percentage increases for total compensation over the past 1-2 years:

Analysts: 20-25%

Associates: 20-25%

VPs: 25-30%

Directors: 25-30%

MDs: N/A (too difficult to determine a single “average”)

At first glance, these seem like impressive increases.

But the true inflation rate is likely at 10-20%, and global investment banking fees were up by even higher percentages!

Read the full report here