Biodiversity Finance for Infrastructure Companies in Emerging Markets: How to Move from Objectives to Actions

IFC Infrastructure

January 27, 2023

At the global biodiversity convening known as the United Nations Biodiversity COP15 in December 2022, representatives from nearly 200 countries signed the historic Kunming-Montreal Global Biodiversity Framework to halt and reverse biodiversity loss by 2030. These losses are largely driven by changes in land and sea use, climate change, and pollution. The framework, which includes 23 targets on biodiversity loss, emphasizes that biodiversity is fundamental to economic prosperity and that halting and reversing biodiversity loss requires a whole-of-government and whole-of-society approach. Ultimately, the framework aims to catalyze a transformation of economic activity: how we can produce and consume in ways that allow nature to regenerate and put nature on the path to recovery.

Why biodiversity matters for infrastructure companies

The World Economic Forum estimates that $44 trillion of economic value generation—more than 50 percent of the world’s GDP—is moderately or highly dependent on nature, and therefore exposed to risks from biodiversity loss. These include physical risks and threats to the availability of ecosystem services on which businesses rely. They also include transition risks, meaning shifts in customer demand and regulation, and reputational risks around the loss of brand value.

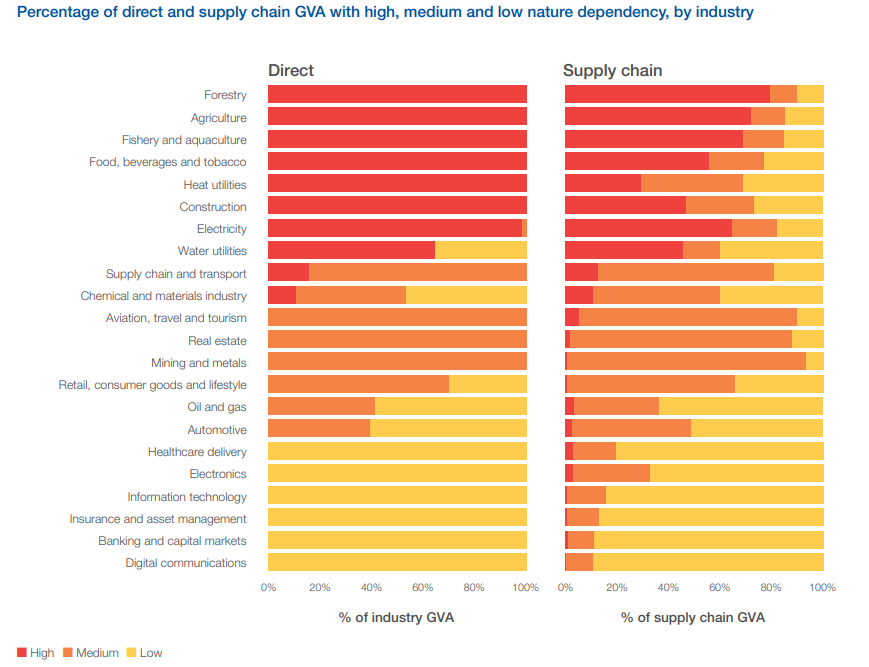

Infrastructure businesses such as electricity companies, water utilities, and transportation companies are among the most dependent on nature, both directly and through their supply chains, as shown in the graph below.

Source: World Economic Forum.

Yet, infrastructure companies are also responsible for a large portion of biodiversity loss, impacting at least 47 percent of the IUCN’s list of threatened or near-threatened species. These impacts are due to greenhouse gas (GHG) emissions, the discharge of untreated wastewater into biodiversity-rich freshwaters, the introduction of invasive species into new environments, inadequate plastic disposal leading to ocean pollution, and the disruption of fragile ecosystems through the construction of roads and dams, among other factors. Many of these externalities further exacerbate climate change. They also jeopardize infrastructure companies’ commitment to climate mitigation and adaptation goals.

At a time when urban environments are expanding rapidly, with an ensuing rise in infrastructure demand, the potential for negative effects on surrounding ecosystems is significant. Given this situation, it is imperative that all future infrastructure investments are sustainable and nature-smart, in addition to being economically viable.

The biodiversity business opportunity

Halting degradation and restoring biodiversity represents an important business opportunity for infrastructure companies, as well as for emerging markets seeking to create new green jobs. This opportunity, estimated at over $6.5 trillion per year, is expected to generate more than 204 million new jobs by 2030. Several business transformation strategies are available to the sector, such as shifting towards nature-based infrastructure designs (e.g., using nature for cooling or heating), investing in smarter and cleaner utilities, or building nature-connecting infrastructure (e.g., eco-bridges).

Restoring biodiversity is also a cost-effective way to reduce carbon emissions. It can reinforce climate resilience and adaptation strategies while also yielding social co-benefits for local communities and stakeholders. A joint report from the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES) and the Intergovernmental Panel on Climate Change notes that actions to protect, sustainably manage, and restore natural and modified ecosystems, and implementation of nature-based solutions can play an important role in climate mitigation and adaptation to climate change.

Forest and non-forest terrestrial ecosystems such as wetlands and peatlands, grasslands, and savannahs can reduce GHG and maintain large carbon sinks. So, too, can coastal ecosystems such as mangroves, salt marshes, and seagrass meadows. Coral reefs can protect coasts from storm surges and rising sea levels, while wetlands help reduce flooding. These natural protections help mitigate climate disaster risks to communities and infrastructure assets while assisting in climate change adaptation.

Ensuring that new “gray” infrastructure such as transport, power, and water assets are embedded with “green” nature-based infrastructure will be critical to reducing carbon footprints and increasing climate resilience. Such efforts are key, given that infrastructure project costs are expected to account for up to 80 percent of total climate change adaptation spending globally—potentially up to $450 billion per year in 2050.

Biodiversity finance as a tool for infrastructure companies

The success of biodiversity protection and restoration will depend on the availability of finance for these projects. The Global Biodiversity Framework states that the investment required to limit biodiversity loss by 2030 is estimated at an average of $700 billion per year. And yet, current investment flows are estimated at only $124–$143 billion. This investment gap is linked to challenges in biodiversity impact measurement, but also to low awareness about nature-based solutions and investments with biodiversity co-benefits.

To help companies and investors identify opportunities for biodiversity finance, IFC has recently released the Biodiversity Finance Reference Guide, which outlines three different investment categories to combat biodiversity loss:

· Investments that generate biodiversity co-benefits: Examples include upgrading wastewater treatment plants to eliminate harmful pollutants, upgrading drainage systems to prevent plastic runoff into water habitats, installing ballast water treatment on ships to limit the spread of invasive species, reducing noise pollution, and identifying alternative shipping routes that protect mammal migrations, among others.

· Investments in biodiversity conservation and restoration as primary objectives: These include investments aimed at generating carbon credits. For example, several mining companies have invested in the rehabilitation and restoration of landscapes around closed mines, going beyond the regulatory requirements.

· Investments in nature-based solutions: Examples include planting native grasses and flowers to cool solar panels, constructing wetlands for water management, and conserving mangroves and coral reefs to reduce flooding and coastal erosion.

Biodiversity indicators to incentivize action

Biodiversity finance instruments range from dedicated financial instruments such as green and blue finance to sustainability-linked loans and sustainability-linked bonds that incorporate biodiversity KPIs. To foster the recourse to sustainability-linked finance products, in 2022 the International Capital Markets Association updated its registry of key performance indicators (KPIs) to include biodiversity as a relevant sustainable finance indicator for certain infrastructure sectors, including maritime transportation, mining and metallurgy, construction, and water and waste utilities.

Other options include the use of biodiversity-related criteria in trade finance. Equity investments also allow for capital deployment in a manner that delivers financial and biodiversity returns, including through private equity funds, incubators, and venture capital firms.

Infrastructure companies are beginning to make use of private financing to fund new projects with benefits for biodiversity. For example, IFC’s $150 million blue loan to SABESP in Brazil will help the company expand sewage collection and treatment while supporting the clean-up of the polluted Pinheiros River and protecting aquatic life.

Bottom line: boosting biodiversity enhances climate, community, and business benefit

Many projects qualifying for such biodiversity finance will accrue both biodiversity and climate mitigation/community adaptation benefits, in addition to business benefits such as a more secure raw material supply. This can help companies meet their climate mitigation/adaptation goals as well as their business objectives.

To be sure, there are challenges in developing replicable cash flow generation mechanisms. And investors need more education and awareness about the variety of biodiversity finance categories. Still, the direct and indirect benefits of integrating nature considerations into infrastructure projects and corporate strategies outweigh the challenges.

IFC can help infrastructure companies interested in attracting biodiversity finance identify emerging investment opportunities and partner with them to implement these projects. By leveraging our expertise in Sustainable Finance, along with our global sector and technical expertise, we bring innovative solutions to the table that can yield biodiversity and community climate adaptation benefits, along with strong business value.