Private Equity Fund Valuation Management During Fundraising

Written By Adrienne Lawler

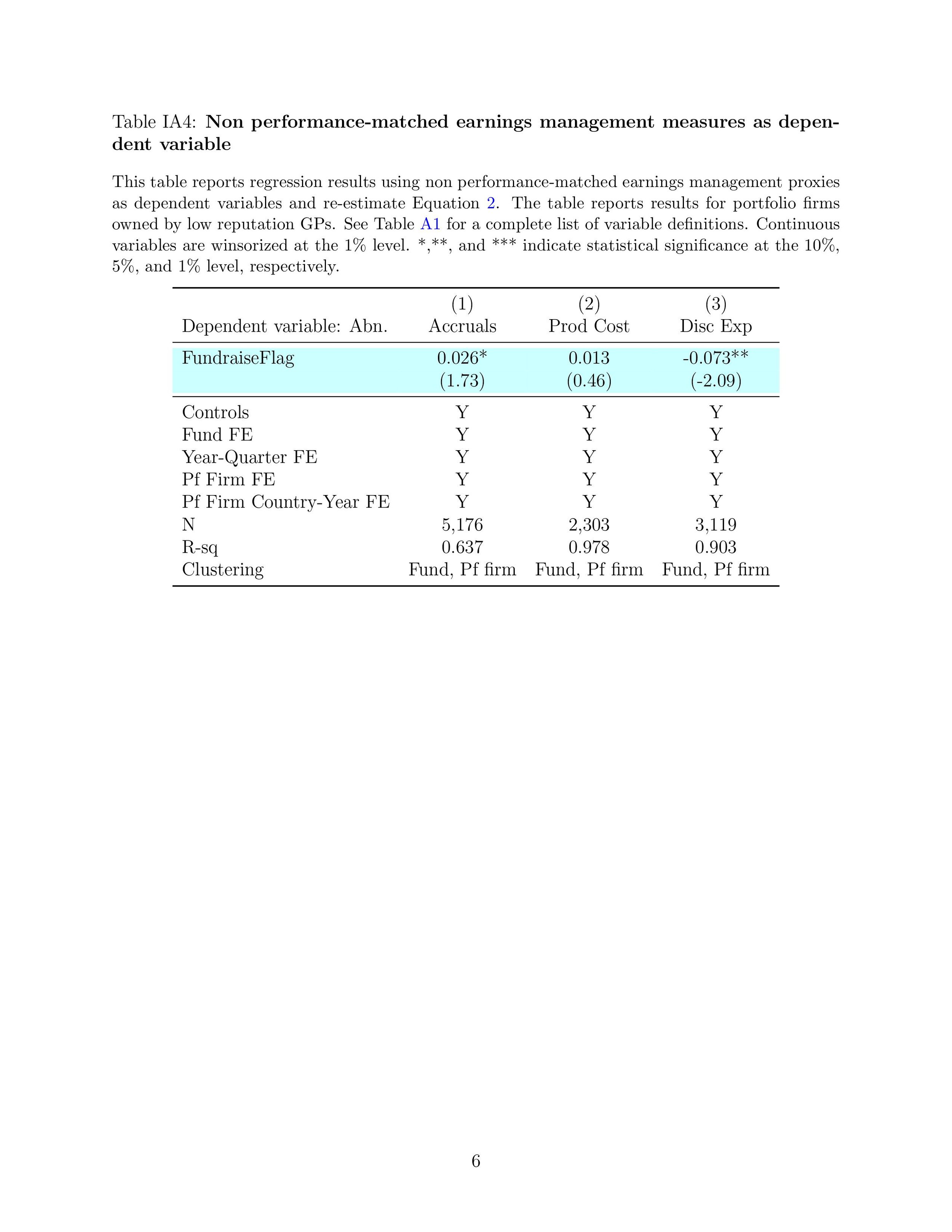

The author investigates whether and how private equity fund managers (GPs) inflate their interim fund valuations (net asset values, or NAVs) during fundraising periods. Specifically, he studies the extent to which the GPs inflate NAVs by managing valuation assumptions (e.g., valuation multiples), influencing the financial metrics (e.g., EBITDA and sales) reported by the private firms in their portfolios, or both. A sample of buyout funds and their portfolio firms in Europe is studied.