New guidance on Sustainable Investments provides fund managers with more flexibility

Bloomberg Professional Services August 14, 2023

This article is written by Nadia Humphreys, Head of Climate Finance and Regulatory solutions and Murat Bozdemir, Head of ESG data content EMEA at Bloomberg

This summer the European Commission and Supervisory Authorities published new guidance on how to determine and quantify Sustainable Investments (SI) in a fund. There was a notable update to allow passive investments tracking climate-transition and Paris-aligned benchmarks to categorise as article 9 under SFDR. In addition, fund managers were given more flexibility on measuring the quantity of SI in a fund using activity or company level methodologies, which means these can vary between providers. Data collected by Bloomberg also shows great variations in the amounts of SI disclosed by funds categorised respectively as article 8 or 9. Investors should therefore make sure to get a detailed understanding of a fund’s sustainability profile.

Manage sustainability-related risks and opportunities

What qualifies as a sustainable investment

The fundamentals, as clarified in our 2022 blog, haven’t changed. The SI figure is a measurement, in percentage terms, of how much of an underlying investment aligns to the investment product’s sustainable goals. It is not a measure of how sustainable a company is, a common misconception.

There are three core steps to determining if an investment can be considered as an SI, which were reiterated in the Q&A document published by the ESAs:

How aligned the investee company is to the overall environmental or social objective of the fund

Whether, by investing in this company, the fund complies with the definition of “do no significant harm” set at the level of the investment firm, using the principle adverse indicators

Whether the investee company complies with ‘good governance’

However, in its June guidance, the European Commission stated that investments in companies with any degree of alignment to the Taxonomy would qualify as SI under SFDR.

Let’s take the example of an investment in an energy company where a portion of the revenue is made from fossil-fuel dependent energy, and another portion (e.g. 40%) from qualifying renewable energy sources (e.g. wind or solar). Assuming the 40% renewable energy portion meets all the technical screening tests of the Taxonomy, then this company would be considered 40% aligned to the turnover Key Performance Indicator of the Taxonomy.

Under the latest guidance, 40% of the turnover automatically qualifies as ‘environmentally sustainable’ under SFDR, and contributes towards the SI calculation, since it’s not necessary to complete the “do no significant harm” or “good governance” steps outlined in SFDR (both conditions are already satisfied given the turnover of the company is Taxonomy-aligned). The remaining 60% that is fossil fuel derived revenue is unlikely to qualify, given the fossil fuel restrictions under principal adverse indicators it may fail many managers’ definition of harm.

New guidance to quantify SI

The new guidance further clarifies that the SI percentage can be measured at company-level, as well as for a specific company activity. Whilst this offers fund managers more flexibility, it also means the SI proportion in funds will vary depending on the methodology that is being used.

Guidance by the ESA’s originally recommended that funds could only be categorized as article 9 if 100% of underlying investments qualify as SIs, with certain exceptions. For example, for the use of liquidity or hedging instruments that are not measurable to environmental or social data sets. However, with the introduction of safe harbours and the notion that SI can now be measured at the company or activity-level, the 100% value falls into question.

Varying amounts of SI in article 8 and 9 funds

As BIoomberg Intelligence analysts wrote in their SFDR Barometer, passive investments tracking climate transition benchmarks or Paris-aligned benchmarks may recategorize as article 9 given the new guidance.

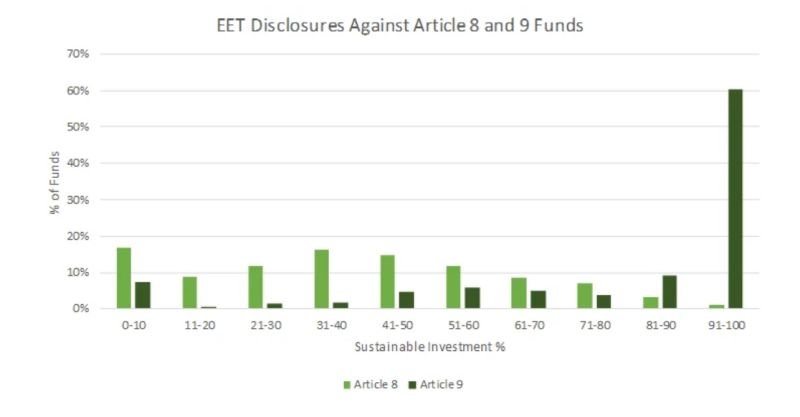

However, looking at European ESG Template (EET) disclosures for Article 8 and 9 SFDR funds shows great variations in the amounts of SI disclosed by funds categorized respectively as article 8 or 9. In the sample of SFDR funds taken by Bloomberg for the figure below, the majority of article 9 funds declare they hold 91-100% SI, only 25 of these funds state they are hitting the 100% SI value. Furthermore, 23 article 8 funds are claiming an SI value over 90%, with five of them at the 100% level.

Figure: Bloomberg Sourced EET disclosures against ~2,500 SFDR classified funds

With these new regulatory clarifications and ongoing industry challenges, investors adding article 8 and 9 funds to their portfolios will need a detailed understanding of a fund’s sustainability profile.

To help investors streamline their screening process for article 8 and 9 funds, Bloomberg provides access to SFDR fund-reported data for 25,000 funds captured with the European ESG Template (EET), covering more than 160 data points including a fund’s minimum EU Taxonomy alignment and the percentage of sustainable investments in the fund.

For more information visit Bloomberg.com/company or request a demo.